Archive

AI – rescuing the spectrum crunch (Part 1)

Chamath Palihapitiya, the straight talking boss of Social Capital recently sat down with Vanity Fair for an interview where he illustrated what his firm looked for when investing. “We try to find businesses that are technologically ambitious, that are difficult, that will require tremendous intellectual horsepower, but can basically solve these huge human needs in ways that advance humanity forward”.

Around the same time, and totally unrelated to Chamath and Vanity Fair, DARPA, the much vaunted US agency credited among other things for setting up the precursor to the Internet as we know it threw up a gauntlet at the International Wireless Communications Expo in Las Vegas. What was it: it was a grand challenge – ‘The Spectrum Collaboration Challenge‘. As the webpage summarized it – “is a competition to develop radios with advanced machine-learning capabilities that can collectively develop strategies that optimize use of the wireless spectrum in ways not possible with today’s intrinsically inefficient static allocation approaches”.

What would this be ‘Grand’? Simply because DARPA had accurately pointed out one of the greatest challenges facing mobile telephony – the lack of available “good” spectrum. In doing so, it also indirectly recognized the indispensable role that communications plays in today’s society. And the fact that continuing down the same path as before may simply not be tenable 10 – 20, 30 years from now when demands for spectrum and capacity simply outstrip what we have right now.

Such Grand Challenges are not to be treated lightly – they set the course for ambitious endeavors, tackling hard problems with potentially global ramifications. If you wonder how fast autonomous cars have evolved, it is in no small measures to programs such as these which fund and accelerate development in these areas.

Now you may ask why? Why is this relevant to me and why is this such a big deal? The answer emerges from a few basic principles, some of which are governed by the immutable laws of physics.

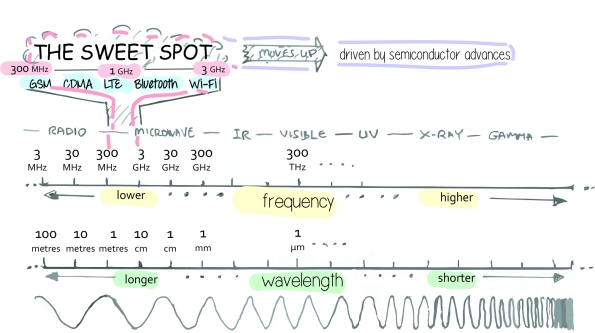

- Limited “good” Spectrum – the basis on which all mobile communications exists is a finite quantity. While the “spectrum” itself is infinite – the “good spectrum” (i.e. between 600 MHz – 3.5 GHz) or that which all mobile telephones use is limited, and well – presently occupied. You can transmit above that (5 GHz and above and yes, folks are considering and doing just that for 5G), but then you need a lot of base stations close to each other (which increases cost and complexity), and if you transmit a lot below that (i.e. 300 MHz and below) – the antenna’s typically are quite big and unwieldy (remember the CB radio antennas?)

Courtesy: wi360.blogspot.com

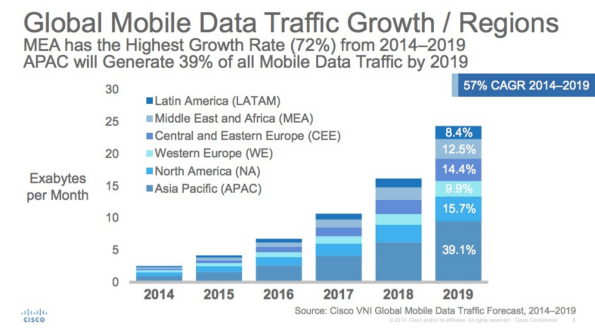

- Increasing demand – if there is one thing all folks whether regulators, operators or internet players agree upon it is this; that we humans seem to have an insatiable demand for data. Give us better and cheaper devices, cool services such as Netflix at a competitive price point and we will swallow it all up! If you think human’s were bad there is also a projected growth of up to 50 Bn connected devices in the next 10 years – all of them communicating with each other, humans and control points. These devices may not require a lot of bandwidth, but they sure can chew up a lot of capacity.

CISCO VNI

- and as a consequence – increasing price to license due to scarcity. While the 700 MHz spectrum auction in 2008 enriched the US Government coffers by USD 19.0 Bn (YES – BILLION), the AWS-3 spectrum (in the less desirable 1.7/2.1 GHz band) auction netted them a mind-boggling USD 45.0 Bn.

One key element which keeps driving up the cost of spectrum is that the business model of all operators is based around a setup which has remained pretty much the same since the dawn of the mobile era. It followed a fairly, well linear approach

- Secure a spectrum license for a particular period of time (sometimes linked to a particular technology) along with a license to provide specific services

- Build a network to work in this spectrum band

- Offer voice, data and other services (either self built) or via 3rd parties to customers

While this system worked in the earlier days of voice telephony it has now started fraying around the edges.

- Regulators are interested that consumers have access to services at a reasonable price and that a competitive market environment ensures the same. However with a looming spectrum scarcity, prices for spectrum are surging – prices which are indirectly or directly passed on to the customer

- If regulators hand spectrum out evenly, while it may level the playing field for the operator it does nothing to address a customer need – that the capacity offered by any one operator may not be sufficient… leaving everyone wanting for more, rather than a few being satisfied

- Finally, the spectrum in many places around the world remains inefficiently used. There are many regions where rich firms hoard spectrum as a defensive strategy to depress competition. In other environments there are cases when an operator who has spectrum has a lot of unused capacity, while another operator operates beyond peak – with poor customer experience. No wonder, previous generations of networks were designed to sustain near peak loads – increasing the CAPEX/ OPEX required to build up and run these networks.

In the next part of this article we will dive deeper into these issues, trying to understand how an AI enabled dynamic spectrum environment may work and in the last note point out what it could mean to the operator community and internet players at large…..

The dynamic pricing game – where all is not 99c

Phil Libin the effervescent CEO at Evernote made headlines two days ago when he admitted that Evernote’s pricing strategy had been a bit arbitrary and a new pricing scheme for their premium offering would be launched come 2015. Although little was said about what the approach would be – I do hope it points to adopting a flexible pricing approach, and serve as a forerunner for pricing strategies to legions of firms down the road.

To put some context, many software providers (especially app companies) have adopted a one price fits all approach; i.e. if the price for the app is $5 per month in USA, the price is $5 per month in India. The argument has typically been one of these

- Companies such as Apple do not practice price differentiation around the world, and yet they sell – so we should also be able to do the same

- Adopting a one price fits all approach streamlines our go-to-markets and avoids gaming by users

- It is unfair to users who would end up paying a premium for a product which can be sourced for a cheaper price elsewhere

From a first hand experience I believe that such attitudes have proven to be the one of the biggest stumbling blocks for firms to achieve global success. A good way to explain why is to pry apart these assertions.

- The Brand proposition argument – Although every firm would love (and some certainly do in a misguided manner) to believe that their firm has a premium niche such as Apple – harsh reality points in a different direction. There are only two brands who top $100 bn – and Apple is one of them; and no – unless you are Google, you are not the other! Even though your brand may be well known in your home of Silicon Valley, its awareness most likely diminishes with the same exponential loss as a mobile signal – its value in Moldova for example – may be close to zero. This simple truth is that there are only a handful of globally renowned brands (e.g. Apple, Samsung, BMW, Mercedes, Louis Vuitton etc) which can carry a large and constant premium around the world.

- The “avoid gaming” argument – this does have some merit, but needs to be considered in the grand scheme of things. Yes – this is indeed possible, but is typically limited to a small cross section of users who have foreign credit cards/ bank accounts etc. The vast majority are domestic users who are limited to their local accounts and app stores. The challenge here is to charge the same fee irrespective of the relative earning power in a country. While an Evernote could justify a $5 per month premium in USA (a place where the average mobile ARPU is close to $40), it is very hard to justify it in South East Asia (mobile ARPU close to $2) or even Eastern Europe (mobile ARPU close to $8). It then would simply limit the addressable market to a small fraction of its overall potential – and dangerously leave it open to other competitors to enter.

| ARPU | $12.66 | $2.46 | $11.37 | $9.20 | $48.15 | $23.88 | $8.77 |

| Region | MENA | APAC | Oceania | LatAm | USA | W.EU | E.EU |

- The unfairness argument – also doesn’t hold true. The “Big Mac Index” stands testament to the fact that price discrimination is an important element of market positioning.

Even if you argue that you cannot buy a burger in one country to sell in another, the same holds for online software – take the example of Microsoft with its Office 365 software product, same product – different country – different price.

- That brings me back to the final point – $5 per month may sound like a good deal if you are a hard core user, but if you compare it with Microsoft Office 365 – which also retails at $5 per month, it is awfully hard to justify why one would pay the same for what is essentially a very good note taking tool.

Against this background, I do welcome the frank admission that this strategy is in need of an update, and also happy to hear that the premium path isn’t via silly advertisements. Phil brought up a good challenge with his 100 year start-up and delighted to know that he still is happy to pivot like one. I do for sure hope that the other “one trick pony” start-ups learn from this and follow suit.

Al la carte versus All you can eat – the rise of the virtual cable operator

Recent announcements by the FCC proposing to change the interpretation of the term “Multi-channel Video Programming Distributor (MVPD)” to a technology neutral one has thrown open a lifeline to providers such as Aereo who had been teetering on the brink of bankruptcy. Although it is a wide open debate if this last minute reprieve will serve Aereo in the long run, it serves as a good inflection point to examine the cable business as a whole.

“Cord cutting” seems to be the “in-thing” these days with more people moving away from cable and satellite towards adopting an on-demand approach – whether via Apple TV, Roku or now – via Amazon’s devices. This comes from a growing culture of “NOW“; rather than wait for a episode at a predefined hour, the preference is to watch a favorite series at a time, place – and now device of ones choosing. Figures estimate up to 6.5% of users have gone this route, with a large number of new users not signing up to cable TV in the first place. The only players who seem to have weathered this till date are premium services such as HBO who have ventured into original content creation, and providers offering content such as ESPN – the hallmark of live sports. Those who want to cut the cord have to end up dealing with numerous content providers – each offering their own services, billing solutions etc. To put together all the services that users like, ends up being a tedious and right now – and expensive proposition.

This opens the door for what can only be known as the Virtual Cable Operator – one which would get the blessings of the FCC proposal. Such an aggregator (could be Aereo) could bundle and offer such channels without investment into the underlying network infrastructure – offering a cost advantage as much as 20% as compared to current offerings. This trend is a familiar one in the Telco business – and cable companies better be ready for this. Right now they may be safe as long as ESPN doesn’t move that route – but with HBO, CBS etc all announcing their own services, I believe it is only a matter of time. While the primary impacts to cable has extensively been covered – there are a few other consequences, and opportunities that I would like to address.

The smaller channels (those who charge <30c to the cable operators) will experience a dramatically reduced audience. Currently there was a chance that someone would stop by while channel flipping – with an al la carte service – this pretty much disappears, and along with it advertising revenue. An easy analogy would be that of an app in an app store – app discovery (in this case channel discovery) becomes highly relevant. Another result is that each channel would be jockeying for space on the “screen” – whether a TV, tablet or phone. I can very well imagine a scenario of a clean slate design like Google on a TV, where based upon your personal interest you would be “recommended” programs to watch – question is who would control this experience…

Who could this be – a TV vendor (a.k.a a Samsung – packaging channiels with the TV), an OEM (Rovio, Amazon etc.), a Telco or cable provider (if you can’t beat them – join ’em), or someone like Aereo? The field is wide open and the jury has yet to make a decision. One thing however is clear – the first with a winning proposition – including channels, pricing and excellent UI would be a very interesting company to invest in…..

Why Germany Dominates the U.S. in Innovation …. or does it?

“Germany dominates the US in Innovation” blared the headline from the HBR blog posted by Dan Breznitz who put across several points to illustrate where and how Germany was better than the US in these respects. As a person who has lived and experienced both sides of the pond I beg to differ. The article does incorporate several facts such as the strong manufacturing base and a good work ethos but in mixing innovation with inequality and other issues I think the author has missed the point, and I would like to elaborate why.

On government sponsored research – the author does extol the large benefits of government based applied research at institutes such as Fraunhofer. True, they are indeed great and have provided many an invention – perhaps the most widely known is the MP3 license. However, there are multiple efforts by the US government in the same direction; key difference being that they prefer to fund private firms to carry out the research on their behalf. Let us take the example of the Small Business Innovation Research and compare (all figures taken from their respective websites)

- Number of institutes/ firms funded

- Fraunhofer: 66 institutes and research facilities around Germany

- SBIR grants: Supporting 15000 small firms all around USA

- Number of people (engineers/ scientists) employed

- Fraunhofer: 22,000 staff

- SBIR grants: 400,000 scientists and researchers

- Funding

- Fraunhofer: annual budget around 1.9 Billion Euro

- SBIR: annual $2.5 Billion

As can be seen, one major program in the US is able to employ 20 times more people and support a whole lot more of private enterprise than focusing on a few big institutes. It is this private capital driven mentality that allowed NASA to downsize and opened the doors to many upstarts who are developing new technologies at a fraction of the cost of what it cost the government under NASA (see SpaceX). From my own experience, small and agile firms are able to innovate at an astonishing rate. Although government funded research is nice, they are typically trapped by layers of bureaucracy and inefficiency which limits their productivity.

The second argument around German leadership in manufacturing; if the American’s learnt one thing early was to franchise, scale and mass produce – all at the lowest cost. This was the key determining factor which led to a flight of capital to developing markets such as China and India which became the manufacturing hubs. In recent times as technology innovations such as automation and 3D printing are becoming more wide spread – we can see manufacturing come back (again to provide a cost advantage). What Germany is definitely good at is in manufacturing, but if you talk to the vaunted mittelstands’ there is a distinct fear that as China and India catch up, this technology edge is fast evaporating as the technology is copied (or sadly robbed due to poor control), localized and enhanced to suit the local market. The US took the other route to economic prosperity – focusing on services rather than manufacturing – which has directly led to the huge explosion in this industry, and the innovation around it (I am considering IT more as a service rather than a traditional manufacturing industry).

Yes – this does bring about inequality, because you end up with a high tier service class (who make the cool software etc), and a lower tier class who “serves” (the fast food server etc) and the absence of a strong “manufacturing” middle class as in Germany. But this is not tied to who is the better innovator, but the impact of the choice to focus on a particular aspect of the food chain i.e. services rather than manufacturing. Putting both in the same pot simply befuddles the discussion.

It is also true that Audi, BMW etc do sell well – but within high-tech you can also see that their connected car platforms are in partnership with the likes of Google and Apple (all US companies). And if you want to talk about cars – the US is one of the few places where you can see the emergence of players such as Tesla to challenge the erstwhile giants.

What Germany trumps the US in is in its social benefits – working hard to ensure higher and more egalitarian employment and a fairer distribution of wealth. This is part of a cultural ethos and mindset rather than an outcome of innovation – and definitely a model to be copied. However, pairing this as an outcome of innovation is far fetched.

In the end, I believe both countries have their own strengths and weaknesses and could do well to learn from each other; In innovation – if anything, Germany could take a piece out of the US system.

Friction-free: enabling happy customers

Last week, I had the good fortune to attend MBLT 2014, a conference all around the rapidly evolving mobile ecosystem. Among the many speakers at the conference, two which piqued my attention were those from Spotify & SoundCloud; both speakers were engaging, and interestingly enough – both talked about growth.

When we talk about growth here, it wasn’t all about entering new markets, or creating new products. It involved a lot of small elements; elements which when brought all together ensured that you gained a lot of users and who kept coming back. Although Spotify and SoundCloud operate in the music space, both (currently) focus on different aspect of this segment. As Andy @ SoundCloud succinctly put it; if Spotify was the Netflix of music, then SoundCloud was Youtube. However, each company seemed to have a common approach when it came to customer acquisition – to develop a friction-less sign up process.

At its core it simply meant reducing the number of clicks, mouse moves etc required to sign up a user and/ or a customer. Both agreed that if any sector was to be considered as “best practice” then it would be mobile gaming – and the king of the hill was… well, King.com. The makers of Candy Crush had got this bang on – all you had to do is download the game and you were good to go.

Their mantra was -> Number of clicks to sign up = 0. Number of users = millions!

Both SoundCloud & Spotify were always on the lookout to make the whole signup process, simpler, quicker and more efficient – fully aware of the fact that complicated processes turned away prospective users, and getting them back wasn’t a trivial matter. That point got me examining different websites to see just how much this mattered (a study done by Spotify as well). After some pottering around, I couldn’t but wholeheartedly agree with the rationale of such an approach.

If you now compare this mentality with IT solutions at traditional corporations you realize how far behind the curve they are in this respect. Many systems there are built more with the paranoia of security and little consideration for user engagement. These are what I call “push systems” – where employees have no choice BUT to use these services mandated by IT. The direct result is that either personnel shy away from using these services, or doing so becomes an irritating chore (especially since they use better designed services on a daily basis). Rather than a full scale rebellion, we are seeing services which simply assist existing ones services such as Brisk.io gaining traction because continuously updating SalesForce is tedious.

A takeaway would be for IT personnel to closely work with end users in deciding how they would like to engage with the services they use on a daily basis. Focusing on small but important elements such as “clicks to complete entries” etc will make employees more enthusiastic on using such services making these more an aid (which was the purpose) rather than a chore!

Bevation – A canary for corporate incubators?

A few weeks ago, my attention was drawn to a small post within Gruenderszene – that of the quiet exit of Bevation, the incubator hosted by Bertelsmann. The exit was so swift, that even the landing page has by now disappeared into cyberspace. This article, coupled with a previous editorial on the same site highlighting the harsh downsizing of other smaller private incubators in 2013 made me speculate where the fortunes of the corporate incubator lay for 2014 and beyond. Was Bevation the proverbial canary for the Old Economy Corporate Incubator as an industry, or was it more as an exception than the rule?

To be fair, the aims and objectives of Bevation had all the makings of a corporate PR exercise, with words such as “innovation”, “exchanging ideas”, “providing insights” liberally interspersed within their vision. My experience has shown that more vague the objectives, the increased likelihood that you will fall short of those objectives. In addition, although Bertelsmann did provide space, facilities and mentoring it stayed away from capital investment. Given that they have a lot of prime real estate in Berlin this would be a cheap way of getting into the startup scene and checking it out, with limited risk. My hunch is that as corporate priorities changed, and management didn’t see any “wow” outcomes interest withered to the point where the validity of its existence itself was challenged. Notes posted on the website of incubated startups such as Snoopet point to this situation. Management was perhaps expecting the next Google or Facebook – what they got were a few startups, some with even unclear business models.

Will this be the same fate for the other corporate incubators? Many of them are doing a lot more, including investing badly needed seed capital in their startups. However, at the same time all of them do need a few heralded and publicized exits (or at least “BIG story”) to validate their approach and business model. In the end it all boils down to some hard decisions – why are we doing this? Is it for revenue, image… or something else (and this something else better be tangible!). If revenue – are we giving the unit sufficient runway to achieve this rather than a quarter by quarter evaluation approach? If image/ PR/ branding – have we achieved this, and is this achievement recognized and aligned with the interest of the management?

My gut feeling is that those that can objectively answer these questions will survive; perhaps even emerge stronger (and better supported) than ever. Those who operate in a wishy-washy environment may be better of in taking heed to the message of the canary…

The nascent VC – Fools rush in!

The good folks at SeedCamp invited me to be a mentor for SeedCamp week in Berlin, and never to miss an opportunity to discover new trends and companies I signed up for the same. The event was very smoothly run, with quite a nice mix of startups ranging from education to financial management, fashion and sustainable farming. Most of them good ideas, but as serial entrepreneurs caution, an idea is one thing… execution is everything.

However, this post is not about the startups – but more about the investor community who were milling around. Before I arrived, I thought I had a good idea of the players within this ecosystem; after yesterday I realized on how much I had undersized this segment. There were players I had never even heard of, and suddenly it seems that there are a lot more VC’s than companies! Some of these firms are niche so if you are not in that industry you may never have heard of them. But among some of the others, I admit if I would be one of their LP’s then I should be justifiably worried. Some definitely seemed qualified, many born out of established VC’s; however there were many running around speaking in platitudes interspersed with jargon. Maybe this impressed some, but left me wondering about their actual capabilities.

The challenge I realize is that there just aren’t a sizeable number of high quality investment opportunities. If you are a good startup, with a good product – you literally have all the VC’s knocking on your door. In this case, major firms such as Earlybird have an advantage since they are well known and can provide you with good, solid advice to help you along the way. Conversely it means that a no-name VC would have to simply outbid an established player (i.e. cough up more cash for lesser equity) just to get a chance to get a foot in the door. They may still lose in this game since most good startups realize the value of strategic advice over money and may still decline such an offer; as Peter Witt (my professor at WHU) liked to say – if you want dumb money, ask your dentist; he will give you the money, and offer no advice!.

What are your options then – well, you then have to target the “not so good firms” to invest. Well that increases your risk…. an odd saying in what is already a highly risky business. Who stands to lose – well, the LP of course! Not only this, even startups should be cautious in working with these – to carefully evaluate what (apart from money) other resources are offered. If you can get money from one, then perhaps you can get money from another – see what else is on the table in terms of support.

But all in all, Berlin is now becoming an increasingly attractive place for folks to come and set up a business. The key is to set up – and hopefully with a well connected Angel investor – who has the right connections and contacts to the right VC’s. So when you grow (with the right advice and investment) you are automatically in the inner circle to help you get to the next stage. And if you are one of those who isn’t sure that his idea is there yet – Berlin is an even more attractive with money floating around…. it wasn’t like this, and not sure how long this will last…. but now it is there… so grab it!

Look before you leap

This is one of those post’s brought about by self-reflection. Over the past twelve or so months I have had the opportunity to interact and listen to many a soul who want to get into the start-up environment. I have heard everyone – from the naysayers to the happy-go-lucky types…. and from this learning (and some of their tears) have put together a few simple thoughts which you may consider before going down this path…

The best time to get into this type of business is typically:

- When you are in school – spend your time interacting, learning and interfacing with others. You really do not have anything to lose, and the upside is quite high. Worst case at the end of 1 – 2 years you will emerge from an amazing learning experience (with very little money), but a good resume.

- When you are very well settled – by this I mean you have enough and more saved up to take care of yourself and your loved ones for at least 2 years. Don’t kid yourself with the illusion that you can rough it out – without having either tried it out first, or having consulted your dependents. You may have no issues eating 1 Euro pizza and Ramen… not sure you would have a partner who is interested in going a similar route.

Now, for the rest of us who are not in these two categories here are some off the cuff tips (specially for Germany!)

- If you have your first job, and even if you hate it – do not leave until you have completed at least 12 months in employment. Why? very simple – after 12 months you qualify for unemployment benefits…. helps getting something from the government rather than none.

- Use the time in the dreaded job to actively examine the following

- Evaluate each fanciful idea you have – ask yourself if there is a real need for this, are you solving a problem that needs solving or trying to create a problem that doesn’t exist. The latter isn’t wrong… but well, awfully hard! Talk to people about it – better still, talk to your enemies. No better criticism comes than from those who despise you. Use the feedback to evaluate, improve or discard the idea. Next remember, an idea in itself isn’t bad or good – success typically depends upon how well you can execute upon the idea. Mediocre ideas will brilliant execution have an excellent chance of success.

- Search for methods of getting money – as a young start-up, you either have to raise cash by asking friends and family, or find an angel. The raw truth about angels is the fact that more often they tend to be vultures. Sure – they will give you money, but would extract a high price in terms of equity. More often you may soon find yourself more as an employee rather than the CXO! However, there are many avenues to get grants – some need a lot of digging and paperwork, which puts off many people. Don’t be deterred – and make sure you do your research, figure out the whole process such that when you are ready, you will know how to get it.

- Save up – you hate your job, and want to start something yourself. Plan ahead and save for it. Pennies count, and they add up. Investors too like it if you can confidently say that you have more than just sweat equity in a firm.

- Hire someone to do the ground-work. Well, if you need some analysis done, a website done etc – it costs money and know-how. Don’t leave your job just yet, but engage someone who can do it for you. That way you have cash coming in until the very point when you HAVE to dive 100% into the running of the firm.

This post may be contrary to many others who may advocate a passionate plunge into the fascinating world of entrepreneurship. But there is an often unseen side of it; of sweat, worry and tears. Some of you (and I hope there will be many to this list) will be lucky, be able to raise capital, have a stellar product and succeed – but most will not (and this is plain statistics). And for those, a bit of planning in advance will prepare them for this period. This does mean that you will most likely not be the star performer in your current job, but well – you aren’t putting 100% into it because its not something you want to do! Focus on your passion, make sure it is well thought through, saved up for – and dive right in. One thing is assured – survival will not be your biggest concern

Partnering at large corporations – secrets to succeed!

In the era of consolidation following the economic crises, many firms turned towards a ‘protect the core’ approach. One often adopted approach was the slashing of R&D budgets and consequently a diminishing pipeline of new products. These now lean companies are facing a new problem – what do you do when your core itself is shrinking! This is being fueled by rapid technology changes which allows substitutes to enter the market, many with a compelling service offering, and many times free of cost!

Given an option to either make (i.e. reinstate the development that you just fired), buy (who knows if this is a hype or will work?) – many large firms are turning to the third, the partner option. At the highest level this would seem simple – there are no integration headaches, no large in-house development costs; but many are realizing this is not as easy as it seems. This is best illustrated by a simple analogy, ‘have you ever seen an elephant dance with a mouse?‘. Nonetheless, rather than give up on what is and should be a clear cornerstone of new products offerings to keep customers happy, large companies can make some concrete steps in this direction.

- Make sure that the partnering and venturing team has the full backing of the management. This simply boils down to the fact that partner products should always be evaluated on par with similar internally developed offerings – no step-motherly treatment here.

- Ensure that the team understands the partner mindset. At best this would also mean that a few members if not all have past experience in such an environment. It is quite difficult to understand the challenges, needs and wants of small firms if you haven’t quite done it yourself.

- Do not subject your partner to the internal functions, realpolitik and bureaucracy in your organization. Instead work hard to make your own internal processes lean, efficient and less cumbersome. Best way to look at it – treat the partner as you would a customer; keep him happy! It is amazing how beneficial this could be to other divisions in your organization as well.

- Invest in being able to effectively manage multiple partnerships. Managing the first 3 – 10 are easy, managing 50 is another story altogether. This does not imply additional layers of complexity – but recognize the need to be abreast of and manage partner needs. The Microsoft way – i.e. categorize partners based upon a few select KPI’s (e.g. revenue, strategic interest etc) and then accordingly assign resources to them is quite effective in this respect. Have to give them credit here – they do know how to manage (without strangling) their partners to a good extent.

- And with all partners – do not be afraid of failure; monitor the progress, recognize if and when it is failing – and move on. Do not throw good money after bad.

- Finally – be patient. The above points may sound simple but do need some time to fall in place and for you see tangible results. Give yourself the time, and make management aware of the same. Last thing you need is the fruits of your labor falling apart halfway through because unrealistic short-term expectations have been set!

Corporate Venturing – Boom or Bust

Hardly a month goes by when you do not hear of an announcement of another large corporate jumping the venturing bandwagon. Like all things, this seems definitely the ‘in’ thing at present. No CEO would want to be caught dead on the ‘what are you doing for innovation’ question – a corporate venturing, whether as a incubator or an accelerator program seems to be the way to go. Depending upon the amount of spare cash they have – fancy offices are opened in Silicon Valley; if you have smaller budgets – then you need to make sure you at least have a prominent location in your home turf.

Although I readily admit I have no statistics to determine whether we have seen any real ‘successes’ from these endeavors, but from the murmurs I hear from insiders, and from some startups who have gone through the process – there seems to be a ton of hot air. There are several reasons for this – but I want to put some thought on the basic structural issues.

For most if not all – this is not a management priority. Sure, you definitely see the entire management with all smiles for the inauguration event, but dig deeper and one realizes that this is perhaps only of peripheral interest. Whenever such a situation occurs, this is a disaster waiting to happen. At every downturn, or ‘consolidation’ in management speak the incubator runs the risk of having its funding severed – cutting the very lifeblood it needs to survive.They are typically managed like the large parent. Many corporate incubators, although starting with the promise of being independent in the end are closely managed – and in many times staffed by personnel from the parent. While in theory this is not such a bad thing, reality is that a startup, seed business is very, very different from the life at a corporation. What you hence end up receiving is either too many processes or procedures, or some cut & paste lean copy of existing corporate structures (this is what the management is comfortable with remember!). This to a large extent, serves to burden the startup – at worse, frighten away good ones.

What it does do however -seems to boost the rating of the company, in particular its management in front of its share-holders. Who doesn’t like an ‘innovative firm’

The result is that many of these firms literally spend a good deal of money publicizing themselves. Maybe this is a strategy which does help the company’s share price!

The management at these corporate incubators receive a salary…. why is that important you ask? well – i call it the ‘getting wet’ problem. Managers are made just too comfortable in the venture. This makes them less likely to take risks – since well, they don’t have anything to loose. Behavioral science teaches us just that, people fear losing a lot more than they enjoy winning. Try asking a corporate venturing manager to take a Euro 10K salary per annum – with the possibility of an endless upside (and downside) … you get the story

If these hypothesis are right, it does lead to the credible possibility that many of these ventures are on life-support, rather than thriving. And worse still – at the sight of the next roller-coaster ride in the economy – many will simply be left to rot. Pity – given independence, a strong (and incentive driven) management and the freedom to fly (even at the cost of cannibalizing the parent) – we may yet see a jewel emerging from this.

Have to admit – I do not want to be a naysayer here, but if things do not change, and soon…. it may only be a matter of time….