Archive

AI – rescuing the spectrum crunch (Part 1)

Chamath Palihapitiya, the straight talking boss of Social Capital recently sat down with Vanity Fair for an interview where he illustrated what his firm looked for when investing. “We try to find businesses that are technologically ambitious, that are difficult, that will require tremendous intellectual horsepower, but can basically solve these huge human needs in ways that advance humanity forward”.

Around the same time, and totally unrelated to Chamath and Vanity Fair, DARPA, the much vaunted US agency credited among other things for setting up the precursor to the Internet as we know it threw up a gauntlet at the International Wireless Communications Expo in Las Vegas. What was it: it was a grand challenge – ‘The Spectrum Collaboration Challenge‘. As the webpage summarized it – “is a competition to develop radios with advanced machine-learning capabilities that can collectively develop strategies that optimize use of the wireless spectrum in ways not possible with today’s intrinsically inefficient static allocation approaches”.

What would this be ‘Grand’? Simply because DARPA had accurately pointed out one of the greatest challenges facing mobile telephony – the lack of available “good” spectrum. In doing so, it also indirectly recognized the indispensable role that communications plays in today’s society. And the fact that continuing down the same path as before may simply not be tenable 10 – 20, 30 years from now when demands for spectrum and capacity simply outstrip what we have right now.

Such Grand Challenges are not to be treated lightly – they set the course for ambitious endeavors, tackling hard problems with potentially global ramifications. If you wonder how fast autonomous cars have evolved, it is in no small measures to programs such as these which fund and accelerate development in these areas.

Now you may ask why? Why is this relevant to me and why is this such a big deal? The answer emerges from a few basic principles, some of which are governed by the immutable laws of physics.

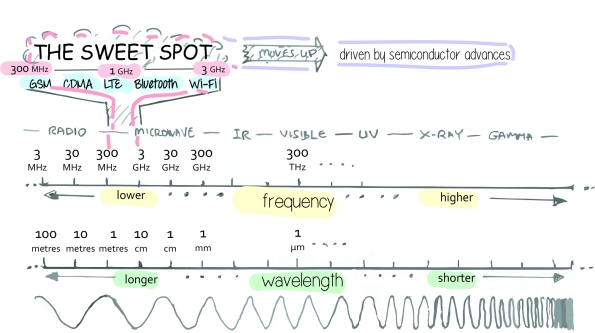

- Limited “good” Spectrum – the basis on which all mobile communications exists is a finite quantity. While the “spectrum” itself is infinite – the “good spectrum” (i.e. between 600 MHz – 3.5 GHz) or that which all mobile telephones use is limited, and well – presently occupied. You can transmit above that (5 GHz and above and yes, folks are considering and doing just that for 5G), but then you need a lot of base stations close to each other (which increases cost and complexity), and if you transmit a lot below that (i.e. 300 MHz and below) – the antenna’s typically are quite big and unwieldy (remember the CB radio antennas?)

Courtesy: wi360.blogspot.com

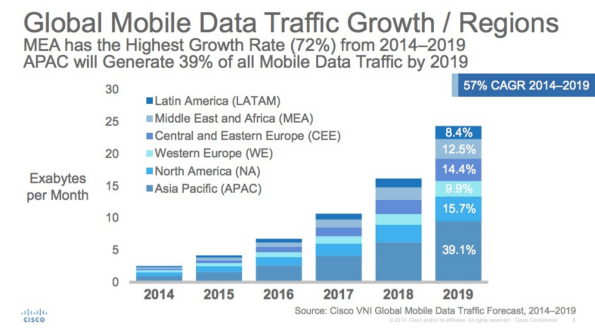

- Increasing demand – if there is one thing all folks whether regulators, operators or internet players agree upon it is this; that we humans seem to have an insatiable demand for data. Give us better and cheaper devices, cool services such as Netflix at a competitive price point and we will swallow it all up! If you think human’s were bad there is also a projected growth of up to 50 Bn connected devices in the next 10 years – all of them communicating with each other, humans and control points. These devices may not require a lot of bandwidth, but they sure can chew up a lot of capacity.

CISCO VNI

- and as a consequence – increasing price to license due to scarcity. While the 700 MHz spectrum auction in 2008 enriched the US Government coffers by USD 19.0 Bn (YES – BILLION), the AWS-3 spectrum (in the less desirable 1.7/2.1 GHz band) auction netted them a mind-boggling USD 45.0 Bn.

One key element which keeps driving up the cost of spectrum is that the business model of all operators is based around a setup which has remained pretty much the same since the dawn of the mobile era. It followed a fairly, well linear approach

- Secure a spectrum license for a particular period of time (sometimes linked to a particular technology) along with a license to provide specific services

- Build a network to work in this spectrum band

- Offer voice, data and other services (either self built) or via 3rd parties to customers

While this system worked in the earlier days of voice telephony it has now started fraying around the edges.

- Regulators are interested that consumers have access to services at a reasonable price and that a competitive market environment ensures the same. However with a looming spectrum scarcity, prices for spectrum are surging – prices which are indirectly or directly passed on to the customer

- If regulators hand spectrum out evenly, while it may level the playing field for the operator it does nothing to address a customer need – that the capacity offered by any one operator may not be sufficient… leaving everyone wanting for more, rather than a few being satisfied

- Finally, the spectrum in many places around the world remains inefficiently used. There are many regions where rich firms hoard spectrum as a defensive strategy to depress competition. In other environments there are cases when an operator who has spectrum has a lot of unused capacity, while another operator operates beyond peak – with poor customer experience. No wonder, previous generations of networks were designed to sustain near peak loads – increasing the CAPEX/ OPEX required to build up and run these networks.

In the next part of this article we will dive deeper into these issues, trying to understand how an AI enabled dynamic spectrum environment may work and in the last note point out what it could mean to the operator community and internet players at large…..

The dynamic pricing game – where all is not 99c

Phil Libin the effervescent CEO at Evernote made headlines two days ago when he admitted that Evernote’s pricing strategy had been a bit arbitrary and a new pricing scheme for their premium offering would be launched come 2015. Although little was said about what the approach would be – I do hope it points to adopting a flexible pricing approach, and serve as a forerunner for pricing strategies to legions of firms down the road.

To put some context, many software providers (especially app companies) have adopted a one price fits all approach; i.e. if the price for the app is $5 per month in USA, the price is $5 per month in India. The argument has typically been one of these

- Companies such as Apple do not practice price differentiation around the world, and yet they sell – so we should also be able to do the same

- Adopting a one price fits all approach streamlines our go-to-markets and avoids gaming by users

- It is unfair to users who would end up paying a premium for a product which can be sourced for a cheaper price elsewhere

From a first hand experience I believe that such attitudes have proven to be the one of the biggest stumbling blocks for firms to achieve global success. A good way to explain why is to pry apart these assertions.

- The Brand proposition argument – Although every firm would love (and some certainly do in a misguided manner) to believe that their firm has a premium niche such as Apple – harsh reality points in a different direction. There are only two brands who top $100 bn – and Apple is one of them; and no – unless you are Google, you are not the other! Even though your brand may be well known in your home of Silicon Valley, its awareness most likely diminishes with the same exponential loss as a mobile signal – its value in Moldova for example – may be close to zero. This simple truth is that there are only a handful of globally renowned brands (e.g. Apple, Samsung, BMW, Mercedes, Louis Vuitton etc) which can carry a large and constant premium around the world.

- The “avoid gaming” argument – this does have some merit, but needs to be considered in the grand scheme of things. Yes – this is indeed possible, but is typically limited to a small cross section of users who have foreign credit cards/ bank accounts etc. The vast majority are domestic users who are limited to their local accounts and app stores. The challenge here is to charge the same fee irrespective of the relative earning power in a country. While an Evernote could justify a $5 per month premium in USA (a place where the average mobile ARPU is close to $40), it is very hard to justify it in South East Asia (mobile ARPU close to $2) or even Eastern Europe (mobile ARPU close to $8). It then would simply limit the addressable market to a small fraction of its overall potential – and dangerously leave it open to other competitors to enter.

| ARPU | $12.66 | $2.46 | $11.37 | $9.20 | $48.15 | $23.88 | $8.77 |

| Region | MENA | APAC | Oceania | LatAm | USA | W.EU | E.EU |

- The unfairness argument – also doesn’t hold true. The “Big Mac Index” stands testament to the fact that price discrimination is an important element of market positioning.

Even if you argue that you cannot buy a burger in one country to sell in another, the same holds for online software – take the example of Microsoft with its Office 365 software product, same product – different country – different price.

- That brings me back to the final point – $5 per month may sound like a good deal if you are a hard core user, but if you compare it with Microsoft Office 365 – which also retails at $5 per month, it is awfully hard to justify why one would pay the same for what is essentially a very good note taking tool.

Against this background, I do welcome the frank admission that this strategy is in need of an update, and also happy to hear that the premium path isn’t via silly advertisements. Phil brought up a good challenge with his 100 year start-up and delighted to know that he still is happy to pivot like one. I do for sure hope that the other “one trick pony” start-ups learn from this and follow suit.

Al la carte versus All you can eat – the rise of the virtual cable operator

Recent announcements by the FCC proposing to change the interpretation of the term “Multi-channel Video Programming Distributor (MVPD)” to a technology neutral one has thrown open a lifeline to providers such as Aereo who had been teetering on the brink of bankruptcy. Although it is a wide open debate if this last minute reprieve will serve Aereo in the long run, it serves as a good inflection point to examine the cable business as a whole.

“Cord cutting” seems to be the “in-thing” these days with more people moving away from cable and satellite towards adopting an on-demand approach – whether via Apple TV, Roku or now – via Amazon’s devices. This comes from a growing culture of “NOW“; rather than wait for a episode at a predefined hour, the preference is to watch a favorite series at a time, place – and now device of ones choosing. Figures estimate up to 6.5% of users have gone this route, with a large number of new users not signing up to cable TV in the first place. The only players who seem to have weathered this till date are premium services such as HBO who have ventured into original content creation, and providers offering content such as ESPN – the hallmark of live sports. Those who want to cut the cord have to end up dealing with numerous content providers – each offering their own services, billing solutions etc. To put together all the services that users like, ends up being a tedious and right now – and expensive proposition.

This opens the door for what can only be known as the Virtual Cable Operator – one which would get the blessings of the FCC proposal. Such an aggregator (could be Aereo) could bundle and offer such channels without investment into the underlying network infrastructure – offering a cost advantage as much as 20% as compared to current offerings. This trend is a familiar one in the Telco business – and cable companies better be ready for this. Right now they may be safe as long as ESPN doesn’t move that route – but with HBO, CBS etc all announcing their own services, I believe it is only a matter of time. While the primary impacts to cable has extensively been covered – there are a few other consequences, and opportunities that I would like to address.

The smaller channels (those who charge <30c to the cable operators) will experience a dramatically reduced audience. Currently there was a chance that someone would stop by while channel flipping – with an al la carte service – this pretty much disappears, and along with it advertising revenue. An easy analogy would be that of an app in an app store – app discovery (in this case channel discovery) becomes highly relevant. Another result is that each channel would be jockeying for space on the “screen” – whether a TV, tablet or phone. I can very well imagine a scenario of a clean slate design like Google on a TV, where based upon your personal interest you would be “recommended” programs to watch – question is who would control this experience…

Who could this be – a TV vendor (a.k.a a Samsung – packaging channiels with the TV), an OEM (Rovio, Amazon etc.), a Telco or cable provider (if you can’t beat them – join ’em), or someone like Aereo? The field is wide open and the jury has yet to make a decision. One thing however is clear – the first with a winning proposition – including channels, pricing and excellent UI would be a very interesting company to invest in…..

In defense of Uber

A few months ago, I had penned some thoughts about the ride sharing battles taking place in Continental Europe, be it the mytaxi or the Lyft’s or the Uber’s of this world. Now, having finally moved back to the Bay I have been a liberal experimenter in all forms of the shared economy to get a better hang on how things move state-side. After having taken over 40 odd Uber/ Lyft rides and having a cheerful discussion with every driver from Moscow to San Francisco and Mexico I would like to revisit and re-examine those deductions.

In San Francisco, the traditional cab business has taken a nose-dive with the regular taxi cab companies losing close to 65% of their regular business and warnings that the viability of their enterprise was at stake. This figure was not surprising; if you’d just take a walk and look around; you would find just as many Ubers and mustachioed Lyfts as regular cabs. Armed with a tech savvy population primed to use the latest apps, and discount after discount offered by the deep pocketed Uber if I was surprised of something it would be questioning why the drop wasn’t even more dramatic!

Upon closer examination of the claim that Uber was destroying the livelihood of the taxi driver, I believe that this is a fallacy since in many locations a taxi driver (if his/ her car met Uber/ Lyft requirements) could become an Uber/ Lyft driver as well. Issues such as “Uber’s dont’ know the neighborhood, or they have not passed the KNOWLEDGE in London ” fall short since navigation technology has progressed to the point to render memorizing entire maps and routes irrelevant. Couple this to addition of user based services such as Waze and I daresay technology trumps the brain.

The two segments that ARE being affected (and consequently the loudest complainers) are the taxi-dispatch companies and the local governments. The first is simply being automated by a service which is more efficient and transparent and well, the second loses on a expensive medallion (or the permit to drive) revenue. If there is a danger to the taxi/ Uber driver in the future, is that an indiscriminate issue of too many Uber “permits” would create too high a supply and not enough economical demand to feed so many drivers. It may not impact the person who would like to make a few bucks on the side, but would turn out to be a risky proposition for those who are leasing new cars just to drive Uber. It sounds tempting to make a quick buck – but driving cabs for long hours is not for the faint hearted…

I am less concerned of issues such as market dominance and monopolization – both from a free market and regulation perspective. In the former, any attempt towards the same would see the rise of alternatives emerging to offering cheaper alternatives (since the technology itself is not unique), and in the latter – governments have time and time again shown the willingness to step in; in this case the Uber would once again become like the regulated “yellow taxis” of old.

But for now, they are here to stay – and all moves to provide efficient, safe and effective transportation to the masses must be applauded and encouraged. GO Uber!

Why Germany Dominates the U.S. in Innovation …. or does it?

“Germany dominates the US in Innovation” blared the headline from the HBR blog posted by Dan Breznitz who put across several points to illustrate where and how Germany was better than the US in these respects. As a person who has lived and experienced both sides of the pond I beg to differ. The article does incorporate several facts such as the strong manufacturing base and a good work ethos but in mixing innovation with inequality and other issues I think the author has missed the point, and I would like to elaborate why.

On government sponsored research – the author does extol the large benefits of government based applied research at institutes such as Fraunhofer. True, they are indeed great and have provided many an invention – perhaps the most widely known is the MP3 license. However, there are multiple efforts by the US government in the same direction; key difference being that they prefer to fund private firms to carry out the research on their behalf. Let us take the example of the Small Business Innovation Research and compare (all figures taken from their respective websites)

- Number of institutes/ firms funded

- Fraunhofer: 66 institutes and research facilities around Germany

- SBIR grants: Supporting 15000 small firms all around USA

- Number of people (engineers/ scientists) employed

- Fraunhofer: 22,000 staff

- SBIR grants: 400,000 scientists and researchers

- Funding

- Fraunhofer: annual budget around 1.9 Billion Euro

- SBIR: annual $2.5 Billion

As can be seen, one major program in the US is able to employ 20 times more people and support a whole lot more of private enterprise than focusing on a few big institutes. It is this private capital driven mentality that allowed NASA to downsize and opened the doors to many upstarts who are developing new technologies at a fraction of the cost of what it cost the government under NASA (see SpaceX). From my own experience, small and agile firms are able to innovate at an astonishing rate. Although government funded research is nice, they are typically trapped by layers of bureaucracy and inefficiency which limits their productivity.

The second argument around German leadership in manufacturing; if the American’s learnt one thing early was to franchise, scale and mass produce – all at the lowest cost. This was the key determining factor which led to a flight of capital to developing markets such as China and India which became the manufacturing hubs. In recent times as technology innovations such as automation and 3D printing are becoming more wide spread – we can see manufacturing come back (again to provide a cost advantage). What Germany is definitely good at is in manufacturing, but if you talk to the vaunted mittelstands’ there is a distinct fear that as China and India catch up, this technology edge is fast evaporating as the technology is copied (or sadly robbed due to poor control), localized and enhanced to suit the local market. The US took the other route to economic prosperity – focusing on services rather than manufacturing – which has directly led to the huge explosion in this industry, and the innovation around it (I am considering IT more as a service rather than a traditional manufacturing industry).

Yes – this does bring about inequality, because you end up with a high tier service class (who make the cool software etc), and a lower tier class who “serves” (the fast food server etc) and the absence of a strong “manufacturing” middle class as in Germany. But this is not tied to who is the better innovator, but the impact of the choice to focus on a particular aspect of the food chain i.e. services rather than manufacturing. Putting both in the same pot simply befuddles the discussion.

It is also true that Audi, BMW etc do sell well – but within high-tech you can also see that their connected car platforms are in partnership with the likes of Google and Apple (all US companies). And if you want to talk about cars – the US is one of the few places where you can see the emergence of players such as Tesla to challenge the erstwhile giants.

What Germany trumps the US in is in its social benefits – working hard to ensure higher and more egalitarian employment and a fairer distribution of wealth. This is part of a cultural ethos and mindset rather than an outcome of innovation – and definitely a model to be copied. However, pairing this as an outcome of innovation is far fetched.

In the end, I believe both countries have their own strengths and weaknesses and could do well to learn from each other; In innovation – if anything, Germany could take a piece out of the US system.

Valley of Dreams – the allure of Silicon Valley (2)

In my last post a few weeks ago, I had alluded to a few reasons for firms wanting to establish a presence in the Valley, and since then have gotten quite a bit of response – with arguments for and against. More than that, people were interested in the “structured argumentation” on how to decide which option best suited them. Took a bit of time to delve into some sound principles to adhere to, but here it is …..

- Reason 1: I want to increase my brand image and project myself as a innovative firm. What better than to have a prominent Silicon Valley address

- If you want to do this, you better have a very deep coffer to draw from and make large and aggressive moves. Only an address will not get you noticed – Sand Hill road is peppered with VC’s, but the deals you make – especially the successful ones will.

- Make sure you hire a few very well connected people who have an established network and get you in the front row seat to maximize visibility. It is all about the network.

- Ensure that your top management at least has some face time there, or there will soon be questions on the ROI of such an investment. Most people, especially top management love the spotlight!

- Reason 2: I want to keep abreast of the latest trends which helps my firm be on the forefront of what is out there, not only for myself but also to lookout for what competitors are doing. No better place to find new ideas popping up (even loony ones) than this small spot of land!

- Good reason; the only question is if this is adequate? You can find enough 3rd party reports and boutique consulting firms who will give you just that – most likely for a fraction of the cost that it takes you to hire and set up an own establishment.

- If you want to do it cheap – subscribe to primary blogs and follow major VC’s – you may not be ahead of the curve, but will certainly be a fast follower. This may be more than sufficient in your market.

- Reason 3: I want to find small, agile firms to partner with and get their cool products to my customers. With a good network within this region I will be able to find a plethora of firms to do just this.

- Even better argumentation than Reason 2. In fact – I would suggest starting with 2 – and if the HQ interest is there, move on to 3.

- Challenge is that you are still a newcomer – and you need guidance and support from Valley insiders to get you going. That being said – there are two additional obstacles that you need to overcome

- First one is external – if you are the newcomer, and you do not have an established pedigree – most of the A list firms (the ones you want) are more difficult to talk to…..

- Second – and a bigger one is internal. We are talking about smaller and much more leaner firms here. They understand and know how to partner with firms like themselves BUT they have little time, money and even less patience to juggle working with a huge firm. To misquote Lou Gerstner – “make sure that the Elephant can first dance”!

- Reason 4: I want to go the Venture Capital (VC) rout; build a VC capability in my firm and invest in young startups. If there is one place I need to be – it is Silicon Valley

- This is the close to the holy grail of most firms, but one which is fraught with danger. If you have never dabbled in this business, and have few connections – stay away.

- A business acquaintance had a saner idea – initially start as a Limited Partner to one of the major VC’s. This does not mean that you will become rich overnight – but will give you two things; help you to gradually understand the ecosystem, and initially start in a “less riskier” approach by leveraging off those who have done it many times in the past (that being said – past performance is not an indicator for the future….)

- Once you have established yourself, built up capabilities and a network – only then should you jump into direct funding.

- Oh – and make sure your management is aware of the time-lines of return, and that you have sufficient independence in management and allocation of funds. The worst thing you can do is have a bean counter who is used to typical corporate metrics evaluate your performance on a quarterly basis!

- Reason 5: I want to engage in serious development at different levels needing close collaboration with experts within the field. Silicon Valley with its proximity to several leading academic and research institutions along with a huge pool of talent is the right place to be…

- Very good – but know what you are getting into. If you just want a brand such as Stanford – sure, this works. But if you want to really develop the next generation of products – then definitely consider the time frame, your risk profile and dedicate people to the cause

- Universities and other institutions are always happy to have your money – but you as a business need to know what you are getting out of it. That being said – I think if you have a clear idea of what you are looking for in the long term – this is definitely a worthwhile avenue to pursue!

That pretty much summarizes it – there are use cases and examples for each, but since this was drawn based upon talking to many people in anonymity, will keep it as is. As in many cases – no right or wrong answer, but more a – it depends -based upon what your ambitions and goals are.

Valley of Dreams – the allure of Silicon Valley (1)

Among the most FAQ that people ask me when abroad the “should I go to Silicon Valley” appears as a common refrain. This is not restricted to individuals alone, but is also common for companies. With the relentless barrage of sky-high valuations, mouth watering exits and very cool technology, who could even resist! In this series of posts, aimed at corporations rather than individuals I have attempted to delve into this topic and provide some guidelines to help you make a decision. Are these “best practice” you may ask? Well – I would fathom I don’t quite know what this equates to; but a significant chunk of this thought process is based upon observing how others did and fared in attempting just this.

So lets just get started by attempting to answer the question “Why should I go to Silicon Valley”. For a majority of firms it boils down to the following options

- I want to increase my brand image and project myself as a innovative firm. What better than to have a prominent Silicon Valley address

- I want to keep abreast of the latest trends which helps my firm be on the forefront of what is out there, not only for myself but also to lookout for what competitors are doing. No better place to find new ideas popping up (even loony ones) than this small spot of land!

- I want to find small, agile firms to partner with and get their cool products to my customers. With a good network within this region I will be able to find a plethora of firms to do just this.

- I want to go the Venture Capital (VC) rout; build a VC capability in my firm and invest in young startups. If there is one place I need to be – it is Silicon Valley

- I want to engage in serious development at different levels needing close collaboration with experts within the field. Silicon Valley with its proximity to several leading academic and research institutions along with a huge pool of talent is the right place to be…

Are you, or is your firm one of them? To be clear, none of these choices are intrinsically wrong….. but deciding which one is the right approach for you requires some clear and structured thinking….