Archive

Infrastructure Edge: Awaiting Development

Editor’s Note: This article originally appeared on the State of the Edge blog. State of the Edge is a collaborative research and educational organization focused on edge computing. They are creators of the State of the Edge report (download for free) and the Open Glossary of Edge Computing (now an official project of The Linux Foundation).

When I began looking into edge computing just over 24 months ago, weeks would go by with hardly a whimper on the topic, apart from sporadic briefs about local on-premises deployments. Back then, there was no State of the Edge Report and certainly no Open Glossary of Edge Computing. Today, an hour barely passes before my RSS feed buzzes with the “next big announcement” around edge. Edge computing has clearly arrived. When Gartner releases their 2018 Gartner Hype Cycle later this month, I expect edge computing to be at the steepest point in the hype cycle.

Coming from a mobile operator heritage, I have developed a unique perspective on edge computing, and would like to double-click on one particular aspect of this phenomenon, the infrastructure edge and its implication for the broader ecosystem.

The Centralized Data Center and the Wireless Edge

So many of the today’s discussions about edge computing ascribe magical qualities to the cloud, suggesting that it’s amorphous, ubiquitous and everywhere. But this is a misnomer. Ninety percent of what we think of as cloud is concentrated in a small handful of centralized data centers, often thousands of miles and dozens of network hops away. When experts talk about connecting edge devices to the cloud, it’s common to oversimplify and emphasize the two endpoints: the device edge and the centralized data center, skipping over the critical infrastructure that connects these two extremes—namely, the cell towers, RF radios, routers, interconnection points, network hops, fiber backbones, and other critical communications systems that liaise between edge devices and the central cloud.

In the wireless world, this is not a single point; rather, it is distributed among the cell towers, DAS hubs, central offices and fiber routes that make up the infrastructure side of the last mile. This is the wireless edge, with assets currently owned and/or operated by network operators and, in some cases, tower companies.

The Edge Computing Land Grab

The wireless edge will play a profound and essential role in connecting devices to the cloud. Let me use an analogy of a coastline to illustrate my point.

Imagine a coastline stretching from the ocean to the hills. The intertidal zone, where the waves lap upon the shore, is like the device edge, full of exciting activities and a robust ecosystem, but too ephemeral and subject to change for building a permanent structure. Many large players, including Microsoft, Google, Amazon, and Apple, are vying to win this prized spot closest at the water’s edge (and the end-user) with on-premises gateways and devices. This is the domain of AWS Greengrass and Microsoft IoT Edge. It’s also the battleground for consumers, with products like Alexa, Android, and iOS devices, In this area of the beach, the battle is primarily between the internet giants.

On the other side of the coastline, opposite the water, you have the ridgeline and cliffs, from where you have an eagle view of the entire surroundings. This “inland” side of the coastline is the domain of regional data centers, such as those owned by Equinix and Digital Realty. These data centers provide an important aggregation point for connecting back to the centralized cloud and, in fact, most of the major cloud providers have equipment in these co-location facilities.

And in the middle — yes, on the beach itself — lies the infrastructure edge, possibly the ideal location for a beachfront property. This space is ripe for development. It has never been extensively monetized, yet one would be foolhardy to believe that it has no value.

In the past, the wireless operators who caretake this premier beachfront space haven’t been successful in building platforms that developers want to use. Developers have always desired global reach along with a unified, developer-friendly experience, both of which are offered by the large cloud providers. Operators, in contrast, have largely failed on both fronts—they are primarily national, maybe regional, but not global, and their area of expertise is in complex architectures rather than ease of use.

This does not imply that the operator is sitting idle here. On the contrary, every major wireless operator is actively re-engineering their networks to roll out Network Function Virtualization (NFV) and Software Defined Networking (SDN), along the path to 5G. These software-driven network enhancements will demand large amounts of compute capacity at the edge, which will often mean micro data centers at the base of cell towers or in local antenna hubs. However, these are primarily inward-looking use cases, driven more from a cost optimization standpoint rather than revenue generating one. In our beach example, it is more akin to building a hotel call center on a beachfront rather than open it up primarily to guests. It may satisfy your internal needs, but does not generate top line growth.

Developing the Beachfront

Operators are not oblivious to the opportunities that may emerge from integrating edge computing into their network; however, there is a great lack of clarity about how to go about doing this. While powerful standards are emerging from the telco world, Multi-Access Edge Computing (MEC) being one of the most notable, which provides API access to the RAN, there is still no obvious mechanism for stitching these together into a global platform; one that offers a developer-centric user experience.

All is not lost for the operator;, there are a few firms such as Vapor IO and MobiledgeX that have close ties to the infrastructure and operator communities, and are tackling the problems of deploying shared compute infrastructure and building a global platform for developers, respectively. Success is predicated on operators joining forces, rather than going it alone or adopting divergent and non-compatible approaches.

In the end, just like a developed shoreline caters to the needs of visitors and vacationers, every part of the edge ecosystem will rightly focus on attracting today’s developer with tools and amenities that provide universal reach and ease-of-use. Operators have a lot to lose by not making the right bets on programmable infrastructure at the edge that developers clamor to use. Hesitate and they may very well find themselves eroded and sidelined by other players, including the major cloud providers, in what is looking to be one of the more exciting evolution to come out of the cloud and edge computing space.

Identifying the next big disruption

Silicon Valley is full of soothsayers and dreamers; some make it their hobby; some have honed it to a fine art but if there is something in common – it is chasing the next big disruptive idea. If you want to put it on the Gartner Cycle – it is at the upswing just before the exponential curve (and way before the inevitable disillusionment trough). At this stage there is a sudden explosion of realization that this may be BIG; followed by a frenzy of investment from the venture capital community with big corporate not far behind – FOMO (fear of missing out) is a tangible worry. Anyone coming in after that is nothing but a speculator, and we all know where they typically end up! The question begets itself to be asked – can we make this event a wee bit more predictable – especially if this could be vastly disruptive in nature? This would be of immense value for all at hand; for the firms engaged in creative disruption, for the folks funding them – and perhaps most of all serving as the canary for those firms about to be disrupted. While a formulaic approach perhaps does not exist – both to predict the nature and timing of the disruption there are some indicators which could be handy.

While difficult to zoom into a particular company, I have observed that the above framework does help in identifying industries which may be prone (and perhaps deserve) to be disrupted.

- Traditional market is saturated and players are more focused on grabbing market share rather than growing the base

- Difficulty for customers to really differentiate between offerings – this can be observed when one relies more heavily on marketing efforts over a clearly better product to do the job

- When all the buzz words are around efficiency and cost cutting is rampant

- And finally, when the core beliefs (including how the customer ticks) is out of sync with today’s world.

- …. There is one more – where a heavily regulated market serves a primary purpose of maintaining status quo rather than fostering innovation!

When these factors coalesce, it quickly becomes apparent that the market landscape is full of stodgy dinosaurs, unable to move fast, to innovate – and the organizations are either at the height of their hubris or incapable of reacting to the writing on the wall.

If one can track these indicators over time (and across players) distinct patterns begin to emerge – and converge. It is then, if you are a smart investor that you need to go hunting. The last barrier (regulation) indeed may create hurdles; but if customer acceptance is gained and it becomes the norm rather than the novelty – then all you need is to stay the course. When that happens – this upcoming disruption will end up as your promising opportunity.

Home Mortgage – ripe for disruption

Aaron LaRue penned an article “Why Startup’s can’t disrupt the mortgage industry” on Techcrunch yesterday where he elaborated on several factors which pointed to the fact that

- The top 200 loan officers in the country made, well way more than revenues of all the startup’s in this space

- Current attempts to disrupt this have failed to meet expectations due to challenges in integrating with legacy technologies, myriad laws and complex procedures

- A way out may be to acquire one of these smaller lenders and then work on changing the innards to better serve a customer.

Courtesy: Flickr.com

I may not be a mortgage expert – but I beg to differ. I have seen such arguments in other vertical sectors as well – and one by one, the onslaught of new technologies have brought about significant change – and even Wall Street is beginning to notice.

- Sectors which are prone (and perhaps should be disrupted) are those with

- High margins

- Antiquated technologies

- Poor customer service

- Opaque processes

- One could easily argue from reading his post that many of these points do apply. The top 200 officers may outclass any robo-originator in service, but when you realize that the median income is only $40,000 – I would daresay that the overall customer satisfaction is low (one reason I love looking at numbers – depending upon what and how you look at it, the picture could be gloomy or rosy) .

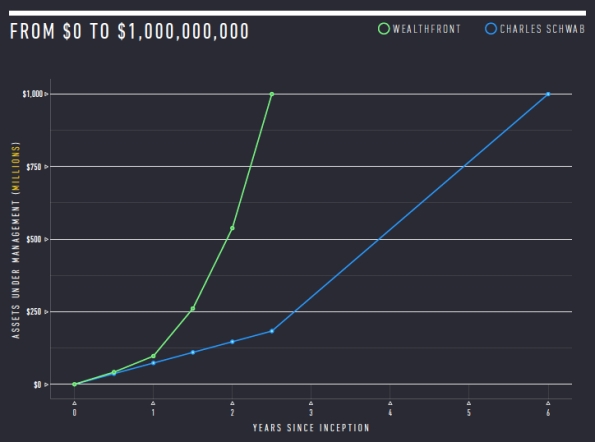

- While Aaron does rightly point out that the revenues are low, what is also clear is that these services have experienced a strong growth trajectory. In part this is also driven by its customer base – potentially a younger, savvy audience who are more attuned to a “digital approach”. While this is small, it is growing – and will be the norm in the future. As a case in point I would refer to both Wealthfront and Betterment; in both these cases their portfolios are dwarfed by giants such as Vanguard – but their astonishing growth points to what is coming. No wonder, incumbents such as Vanguard themselves have established similar Robo-advisors.

Courtesy: Wealthfront

- Another point made is to acquire a lender and then begin to innovate. I am not sure that is a wise decision, unless it comes with a ready stream of customers. An example of this would be Worldpay versus Adyen or Stripe. They all are in the payments business but the latter two have built a efficient business from the ground up – using the latest of what technology has to offer, while Worldpay – although innovative has to balance both new and legacy needs. This is hard to do so – no wonder larger players find it so difficult to compete. The new players have none of this baggage to deal with and hence are far more flexible to respond to changing business needs.

We don’t need another technology patchwork to mend what is a stodgy business. We do need a fresh look and a willingness to invest and challenge the status-quo. When hurdles present themselves – firms will find a way, if there is a clear and present need. SoFi recently launched hedge fund points to this.

We need more disruption, not less. The mortgage industry as a whole could well deserve it!

AI – rescuing the spectrum crunch (part 3)

Part 1 of this post was all about the reasons why DARPA was right when it assigned a Grand Challenge to try and tackle the looming spectrum crises. Part 2 talked about the operating scenarios – on how this could probably pan out in practice. In this concluding chapter I will attempt to determine the impact for both traditional and new players.

_________________________________________________________________

For the regulator, it brings the “uberization” concept right to his doorstep – promoting economic virtues of the efficient utilization of spectrum. Since spectrum could be acquired “on the fly”, the upfront payments made by operators would be replaced by transaction based income with dynamic pricing based upon supply and demand. It would dissuade spectrum hoarding and introduce a heightened level of competition – one which could benefit the end consumer.

For the operator, it would significantly level the playing field since all operators would have access to the same spectrum – one they previously acquired for exclusive use. Those operators which would successfully woo the customer would win; premium operators would be able to engage high value customers by securing access to additional spectrum and hence additional capacity. It would open up a market for newer players not willing to play that game – instead targeting lower tier customers (those who potentially do not need high speed data). The lack of upfront investment in spectrum would allow operators to efficiently allocate capital to better serve customer needs. They could also sell this capability as a service to other service providers (a.k.a. Netflix) who may need a particular QoS and throughput – and are willing to pay for it.

But the biggest impact I suspect will be for the newer entrants. All these players seek to provide a great user experience to the customer irrespective of his operator. If we take a potential case such as 4K streaming where only one provider has a majority of the spectrum – then trying to stream with another operator would result in a poorer user experience (this of course leads to a lock in scenario) . With dynamic allocation – you could simply define different tiers (and quality levels) for your users and partner with all infrastructure players (e.g. operators) to ensure that spectrum can be made available on demand for your service; thus ensuring a high quality experience (for the money you have paid).

Does it drive the operator down the bit pipe…. perhaps yes and no. While the operator would not be the face to the end customer, it would by its very nature foster a closer collaboration between the operator and the end service provider. The customer could very well be the ultimate winner – with companies pandering to best serve their needs.

With potential global ramifications – I see some very clever ideas coming out of the wood-work, and folks such as Chamath investing in this “world changing” technologies to make a difference. I just hope that the big Telcos and/ or the FCC and other regulators don’t view this as a threat to the status quo – rather an opportunity to derive additional value from an already scarce resource!

AI – rescuing the spectrum crunch (Part 1)

Chamath Palihapitiya, the straight talking boss of Social Capital recently sat down with Vanity Fair for an interview where he illustrated what his firm looked for when investing. “We try to find businesses that are technologically ambitious, that are difficult, that will require tremendous intellectual horsepower, but can basically solve these huge human needs in ways that advance humanity forward”.

Around the same time, and totally unrelated to Chamath and Vanity Fair, DARPA, the much vaunted US agency credited among other things for setting up the precursor to the Internet as we know it threw up a gauntlet at the International Wireless Communications Expo in Las Vegas. What was it: it was a grand challenge – ‘The Spectrum Collaboration Challenge‘. As the webpage summarized it – “is a competition to develop radios with advanced machine-learning capabilities that can collectively develop strategies that optimize use of the wireless spectrum in ways not possible with today’s intrinsically inefficient static allocation approaches”.

What would this be ‘Grand’? Simply because DARPA had accurately pointed out one of the greatest challenges facing mobile telephony – the lack of available “good” spectrum. In doing so, it also indirectly recognized the indispensable role that communications plays in today’s society. And the fact that continuing down the same path as before may simply not be tenable 10 – 20, 30 years from now when demands for spectrum and capacity simply outstrip what we have right now.

Such Grand Challenges are not to be treated lightly – they set the course for ambitious endeavors, tackling hard problems with potentially global ramifications. If you wonder how fast autonomous cars have evolved, it is in no small measures to programs such as these which fund and accelerate development in these areas.

Now you may ask why? Why is this relevant to me and why is this such a big deal? The answer emerges from a few basic principles, some of which are governed by the immutable laws of physics.

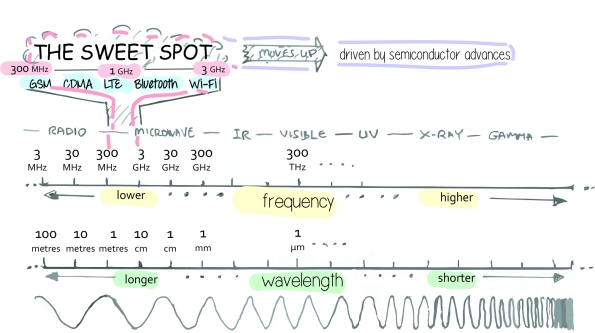

- Limited “good” Spectrum – the basis on which all mobile communications exists is a finite quantity. While the “spectrum” itself is infinite – the “good spectrum” (i.e. between 600 MHz – 3.5 GHz) or that which all mobile telephones use is limited, and well – presently occupied. You can transmit above that (5 GHz and above and yes, folks are considering and doing just that for 5G), but then you need a lot of base stations close to each other (which increases cost and complexity), and if you transmit a lot below that (i.e. 300 MHz and below) – the antenna’s typically are quite big and unwieldy (remember the CB radio antennas?)

Courtesy: wi360.blogspot.com

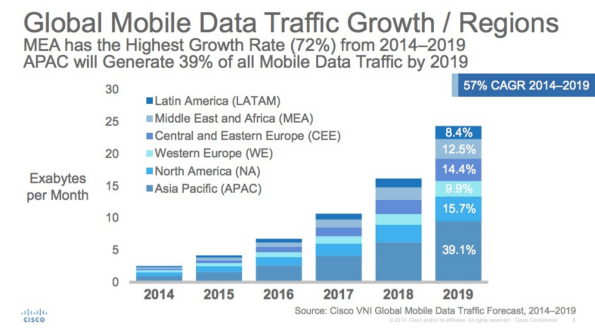

- Increasing demand – if there is one thing all folks whether regulators, operators or internet players agree upon it is this; that we humans seem to have an insatiable demand for data. Give us better and cheaper devices, cool services such as Netflix at a competitive price point and we will swallow it all up! If you think human’s were bad there is also a projected growth of up to 50 Bn connected devices in the next 10 years – all of them communicating with each other, humans and control points. These devices may not require a lot of bandwidth, but they sure can chew up a lot of capacity.

CISCO VNI

- and as a consequence – increasing price to license due to scarcity. While the 700 MHz spectrum auction in 2008 enriched the US Government coffers by USD 19.0 Bn (YES – BILLION), the AWS-3 spectrum (in the less desirable 1.7/2.1 GHz band) auction netted them a mind-boggling USD 45.0 Bn.

One key element which keeps driving up the cost of spectrum is that the business model of all operators is based around a setup which has remained pretty much the same since the dawn of the mobile era. It followed a fairly, well linear approach

- Secure a spectrum license for a particular period of time (sometimes linked to a particular technology) along with a license to provide specific services

- Build a network to work in this spectrum band

- Offer voice, data and other services (either self built) or via 3rd parties to customers

While this system worked in the earlier days of voice telephony it has now started fraying around the edges.

- Regulators are interested that consumers have access to services at a reasonable price and that a competitive market environment ensures the same. However with a looming spectrum scarcity, prices for spectrum are surging – prices which are indirectly or directly passed on to the customer

- If regulators hand spectrum out evenly, while it may level the playing field for the operator it does nothing to address a customer need – that the capacity offered by any one operator may not be sufficient… leaving everyone wanting for more, rather than a few being satisfied

- Finally, the spectrum in many places around the world remains inefficiently used. There are many regions where rich firms hoard spectrum as a defensive strategy to depress competition. In other environments there are cases when an operator who has spectrum has a lot of unused capacity, while another operator operates beyond peak – with poor customer experience. No wonder, previous generations of networks were designed to sustain near peak loads – increasing the CAPEX/ OPEX required to build up and run these networks.

In the next part of this article we will dive deeper into these issues, trying to understand how an AI enabled dynamic spectrum environment may work and in the last note point out what it could mean to the operator community and internet players at large…..

Pebble – mounting troubles in the wearable space

4 days ago, Pebble announced a massive round of layoffs with ~25% of the firm being given the pink slip. In a statement, CEO Eric Migicovsky pointed out to an increasingly difficult funding environment which limited its options to grow and expand. This was a very different situation from just over a year ago when Pebble broke not one, but two kickstarter records – raising the fastest million in 49 minutes and the highest amount in fund-raising, raising $13.3 m (a total of $20,336,930 from 78,463 people over two iterations).

As a curious onlooker into the wearable space, and keenly aware that apart from my super early adopter friends, few if any (especially outside the US) have heard about Pebble I have increasing doubts on the viability of the firm in its present state, however innovative it may have been. A few reasons point to this which I will try and illustrate.

- Flop of the Apple Watch: For all its hype the behemoth in this market, the one that everyone hope would raise the profile of wearables – Apple, has fallen way short of expectations. While Apple proudly announced the sale of 48m iPhones in 1 quarter, it declined to state the number of watch sales….. maybe nothing to crow home about. Add to the fact that Apple has itself dropped the price does not bode well for the product in its present form. While Apple can afford such failures while sitting on billions of cash, Pebble with its limited financial power and debt burden – cannot.

- Entry of competitively entrants with an established eco-system: at the recently concluded MWC in Barcelona, Chinese manufacturers such as Huawei launched several native Android wearables. These actually look quite good, and best of all – already have over 3000 apps on the Google Play store. Maybe items such as e-ink with a longer battery life like Pebble are good to have, but by now users are getting accustomed to charge their devices regularly – adding a watch to the mix isn’t a huge behavior change. While Pebble did announce an entry into India in partnership with Amazon, I fail to see how this can change their fortunes. In India – those who have money can and will buy an Apple watch; those that don’t… well they will look at their options, and for the Indian market, Pebble isn’t the cheapest smart watch around. Pebble would have to go below $40 for it base model to even hope to make a difference.

- Lack of an ecosystem: I think this is one of the biggest challenges that Pebble faces. Microsoft and Blackberry faced (and continues to face) the same challenge with its Windows phones. Without a healthy and growing ecosystem it will always be an uphill battle to attract customers. Apple’s success is testament to this – it was clear that while Apple perhaps would never match Samsung and the others in pure feature set, what set it apart was good design, intuitive UI/ UX and an expansive ecosystem. Remove one of these elements from the mix and you quickly fell to the way-side. And if you closely look at Pebble’s ecosystem it is wanting both in terms of quality (ratings) and quantity.

- Limited user benefit: this one brings the point home. Similar to the Apple watch, most people haven’t yet found compelling use cases in this space; they are “good to have”… not “must haves”. Those that are early adopters already have it, those who are followers can now consider a cheaper Apple watch, or from a plethora of Google gear at different price points. What you end up with is a niche who either hate Apple and Google or simply want to be different. Is this market big enough to support Pebble – and do so now? Or is this market still in a nascent phase and needs time – which Pebble may not have?

I do feel sorry for Pebble, I really do. Hardware is hard enough, building hardware and a viable ecosystem only compounds the problem. While it is admirable (and we do need brave firms such as these) to innovate in spite of these challenges, without a long term plan (and backing) along with a solid team I feel that Pebble is faced with an insurmountable and impossible task. The only solace I do have is for their employees (both current and past); those adventurous souls who took the path less traveled. The wearable industry will continue to grow and the skills and learning that they have gained here will make them highly sought after in an increasingly competitive environment for talent.

The curse of the gatekeeper – thoughts on Eyeo and Shine

A trip up the Rhine is one of those quintessential romantic getaway’s that should be on everyone’s bucket list should they pass through Cologne, Germany. The calm meandering river, multitude of castles and vineyards that dot the hills are a sight to behold. When taking this trip, at a spot around a bend, one comes across an interesting sight. A mini-fort perched upon a rocky outcrop in the middle of the river. As the story goes, an entrepreneurial nobleman built it to collect levy from the numerous barges that moved up and down. Failure to pay nearly always meant that you were … well easy pickings to the cannons pointed right at you. Some called this simply a “tax collector”, others “a gatekeeper”…. still others an “extortionist” (among the kinder choice to words to be used).

It brings us to the subject of my note today – that of ad-blockers whether browser or network based (with Eyeo and Shine their key proponents). First, some basic context to this discussion is necessary. A majority of us are blissful consumers of the “internet” and in many countries it has become an essential and indispensable feature of our existence, along with water, food, electricity and telecommunications. Could you imagine life without it? One the the key reasons behind this dependency (and for many – an addiction) is the simple fact that most of it is free. You heard that right – FREE. When you pay your monthly Internet bill, you are not paying for the content, but to use the infrastructure that the cable and telecom providers have put in to access the internet. On the actual web itself you have two broad classes of content; transaction, such as web-shops where people hope you will buy something, and ad supported. While there are indeed a several instances of malicious advertising and malware etc., for many portal advertising is a necessary evil. The money earned simply pays the bills to create and host this content. Leading respected publications such as ARS Technica have come out in the public, pleading with their readers to allow ads, without which they would have to either turn to a pay per use (paywall) approach or simply turn off the lights. While the former approach does work in select cases (e.g. the Wall Street Journal) for a majority of long tail content, ads are the only source of revenue. Even sites such as Wikipedia raise money every year in order to keep their site ad free. That’s about it – either the consumer pays, or the advertiser pays, there is nothing like a free lunch.

This is where folks such as Eyeo with its Adblock Plus and Shine with its network based technologies enter the game. While free to download in the case of Adblock, it effectively blocks publishers from displaying advertisement unless they agree to pay Eyeo to be white-listed and adopt their standard. While they do have guidelines of what kind of ads are allowed, Eyeo still retains the ultimate authority on which ads are permitted and which not. The claim is the the user will have a “better customer experience”. Better than what? would it be better that the websites that users use went to a paywall model so that customers had to pay each time they accessed a website without advertisements, or that they no longer had access to the website because the firm went bust over a loss of revenue. In the case of Shine, advertisements are blocked at the network level; while some operators such as Three have signed up, others such as O2 have hesitated. Not suprising, while you may want to strong arm Google a bit, an operator still depends upon Google for its Android OS – and need to satisfy their customers. At the same time, advertising is also driving new revenue streams, so better to work towards more engagement rather than destroy this all together. Taking this in mind We must ask ourselves a few questions

1. Just as we may distrust Facebook or Google, can we trust a for-profit firm to have our best interests as a consumer? and in many cases – if it was a governmental entity – would you trust a government?

2. If we do not want to end up paying to access content or loosing access altogether, are we willing and able to tolerate advertisements as a necessary evil

3. Does better customer experience imply no advertisements at all – or perhaps, more relevant advertisements tailored to my interests?

If for any reason the first two answers are no, and we still do not want advertisements, then one option would be to charge a “tax” similar to the UK BBC tax or the TV tax in Germany. Although this may sound simple – it is a lot harder than you may think. Questions would arise such as “is this tax to be uniform – or dependent upon how much you consume; or how do you distribute the monies to all the content producing firms – especially if they may not even be registered in your country?” In this digital day and age – this is easier said than done. My hunch is that the solution lies in the third answer – to offer a better customer experience (to those who desire it) by more relevant advertisements. If you didn’t want to be tracked, you would still get advertisements, perhaps not as relevant – but this is a trade-off that you as a consumer would make.

This may sound as a death knell to the gatekeepers, but well – neither them nor the fortress on the Rhine were universally liked. By adopting a contorted vision of what a customer-centric browsing experience should be (tailored towards profit taking), it simply introduced a cost to a system – a cost which directly or indirectly would be passed on to you and me, the end customers.

Google Fi…. a case of self service and identity

The past couple of days have been quite interesting, with the launch of Google’s MVNO service. Although I still stick to my earlier stance, there are a few interesting nuggets which are worth examining. I will not go into examining the details of the service, you can find them all over the internet – such as here, but more look at a couple of avenues which are much less talked about – which I feel are very relevant.

The first is the idea of a carrier with complete self-service. Now self service is not rocket science – but when you look at legacy firms (and yes – i mean regular Telco’s) this does account for a LOT. In the current ecosystem of cost cutting – one of the largest areas you can reduce costs is in head-count. To give you an idea what this means for a US Telco – one only needs to read news around the consolidation of call centers from both T-Mobile and Verizon. We are not talking of 100 – 200 people here, we are literally talking about thousands of people! And people cost money – and training, and well can even indulge in illegal activities like selling your social security details! If you have a very well designed self service – you could do away with most (I daresay say even all) of them and voila – you have a lean service which meets a majority of your customer needs. In this case, although you end up buying wholesale minutes/ data from operators – you have none of the hassles of operating a network, and certainly none of the expensive overhead such as a call center. No wonder you can match price with the competition – and perhaps do so at an attractive margin! Not sure if Google already has this in place, but I believe it does have the computing and software wizardry to accomplish this.

The next is in the concept of a phone number as your identity. This has been sacrosanct to operator till now – and Google has smartly managed to wiggle its way in. Now it really doesn’t make a difference what device you use – all your calls will be routed via IP – so the number is no longer “tied” to your device. Maybe in the future – your number would be no longer relevant, maybe it would only be an IP address. What would be important is your identity. Simply speaking, perhaps you could go to any device and login with your credentials – and you see the home-screen as it configured for you.. irrespective of device.

However, here I find it difficult to understand Google’s approach. For a unique identity they chose to go with Google Hangouts…. and although I don’t know usage figures – I doubt if this is a very “popular” platform to begin with. Is this Google’s way of trying to push the adoption of Google Hangouts, especially since most of its efforts around social have proven to be a lot of smoke without fire? Will this approach limit its appeal to the few who are Hangout supporters, is this the first salvo in a wider range of offerings, or will this be a one trick pony to rocket Google on the social map … only time may tell.

But one thing is certain, such services will serve to force operators to keep optimizing – using techniques such as self service to reduce costs and offer even better solutions to their customers – at better price points. Maybe in a way it is not unlike Google Fiber – it serves to push the market in the right direction rather than be a game changer on its own. That in itself – would be worthy of applause.

The dynamic pricing game – where all is not 99c

Phil Libin the effervescent CEO at Evernote made headlines two days ago when he admitted that Evernote’s pricing strategy had been a bit arbitrary and a new pricing scheme for their premium offering would be launched come 2015. Although little was said about what the approach would be – I do hope it points to adopting a flexible pricing approach, and serve as a forerunner for pricing strategies to legions of firms down the road.

To put some context, many software providers (especially app companies) have adopted a one price fits all approach; i.e. if the price for the app is $5 per month in USA, the price is $5 per month in India. The argument has typically been one of these

- Companies such as Apple do not practice price differentiation around the world, and yet they sell – so we should also be able to do the same

- Adopting a one price fits all approach streamlines our go-to-markets and avoids gaming by users

- It is unfair to users who would end up paying a premium for a product which can be sourced for a cheaper price elsewhere

From a first hand experience I believe that such attitudes have proven to be the one of the biggest stumbling blocks for firms to achieve global success. A good way to explain why is to pry apart these assertions.

- The Brand proposition argument – Although every firm would love (and some certainly do in a misguided manner) to believe that their firm has a premium niche such as Apple – harsh reality points in a different direction. There are only two brands who top $100 bn – and Apple is one of them; and no – unless you are Google, you are not the other! Even though your brand may be well known in your home of Silicon Valley, its awareness most likely diminishes with the same exponential loss as a mobile signal – its value in Moldova for example – may be close to zero. This simple truth is that there are only a handful of globally renowned brands (e.g. Apple, Samsung, BMW, Mercedes, Louis Vuitton etc) which can carry a large and constant premium around the world.

- The “avoid gaming” argument – this does have some merit, but needs to be considered in the grand scheme of things. Yes – this is indeed possible, but is typically limited to a small cross section of users who have foreign credit cards/ bank accounts etc. The vast majority are domestic users who are limited to their local accounts and app stores. The challenge here is to charge the same fee irrespective of the relative earning power in a country. While an Evernote could justify a $5 per month premium in USA (a place where the average mobile ARPU is close to $40), it is very hard to justify it in South East Asia (mobile ARPU close to $2) or even Eastern Europe (mobile ARPU close to $8). It then would simply limit the addressable market to a small fraction of its overall potential – and dangerously leave it open to other competitors to enter.

| ARPU | $12.66 | $2.46 | $11.37 | $9.20 | $48.15 | $23.88 | $8.77 |

| Region | MENA | APAC | Oceania | LatAm | USA | W.EU | E.EU |

- The unfairness argument – also doesn’t hold true. The “Big Mac Index” stands testament to the fact that price discrimination is an important element of market positioning.

Even if you argue that you cannot buy a burger in one country to sell in another, the same holds for online software – take the example of Microsoft with its Office 365 software product, same product – different country – different price.

- That brings me back to the final point – $5 per month may sound like a good deal if you are a hard core user, but if you compare it with Microsoft Office 365 – which also retails at $5 per month, it is awfully hard to justify why one would pay the same for what is essentially a very good note taking tool.

Against this background, I do welcome the frank admission that this strategy is in need of an update, and also happy to hear that the premium path isn’t via silly advertisements. Phil brought up a good challenge with his 100 year start-up and delighted to know that he still is happy to pivot like one. I do for sure hope that the other “one trick pony” start-ups learn from this and follow suit.

Al la carte versus All you can eat – the rise of the virtual cable operator

Recent announcements by the FCC proposing to change the interpretation of the term “Multi-channel Video Programming Distributor (MVPD)” to a technology neutral one has thrown open a lifeline to providers such as Aereo who had been teetering on the brink of bankruptcy. Although it is a wide open debate if this last minute reprieve will serve Aereo in the long run, it serves as a good inflection point to examine the cable business as a whole.

“Cord cutting” seems to be the “in-thing” these days with more people moving away from cable and satellite towards adopting an on-demand approach – whether via Apple TV, Roku or now – via Amazon’s devices. This comes from a growing culture of “NOW“; rather than wait for a episode at a predefined hour, the preference is to watch a favorite series at a time, place – and now device of ones choosing. Figures estimate up to 6.5% of users have gone this route, with a large number of new users not signing up to cable TV in the first place. The only players who seem to have weathered this till date are premium services such as HBO who have ventured into original content creation, and providers offering content such as ESPN – the hallmark of live sports. Those who want to cut the cord have to end up dealing with numerous content providers – each offering their own services, billing solutions etc. To put together all the services that users like, ends up being a tedious and right now – and expensive proposition.

This opens the door for what can only be known as the Virtual Cable Operator – one which would get the blessings of the FCC proposal. Such an aggregator (could be Aereo) could bundle and offer such channels without investment into the underlying network infrastructure – offering a cost advantage as much as 20% as compared to current offerings. This trend is a familiar one in the Telco business – and cable companies better be ready for this. Right now they may be safe as long as ESPN doesn’t move that route – but with HBO, CBS etc all announcing their own services, I believe it is only a matter of time. While the primary impacts to cable has extensively been covered – there are a few other consequences, and opportunities that I would like to address.

The smaller channels (those who charge <30c to the cable operators) will experience a dramatically reduced audience. Currently there was a chance that someone would stop by while channel flipping – with an al la carte service – this pretty much disappears, and along with it advertising revenue. An easy analogy would be that of an app in an app store – app discovery (in this case channel discovery) becomes highly relevant. Another result is that each channel would be jockeying for space on the “screen” – whether a TV, tablet or phone. I can very well imagine a scenario of a clean slate design like Google on a TV, where based upon your personal interest you would be “recommended” programs to watch – question is who would control this experience…

Who could this be – a TV vendor (a.k.a a Samsung – packaging channiels with the TV), an OEM (Rovio, Amazon etc.), a Telco or cable provider (if you can’t beat them – join ’em), or someone like Aereo? The field is wide open and the jury has yet to make a decision. One thing however is clear – the first with a winning proposition – including channels, pricing and excellent UI would be a very interesting company to invest in…..