Archive

Home Mortgage – ripe for disruption

Aaron LaRue penned an article “Why Startup’s can’t disrupt the mortgage industry” on Techcrunch yesterday where he elaborated on several factors which pointed to the fact that

- The top 200 loan officers in the country made, well way more than revenues of all the startup’s in this space

- Current attempts to disrupt this have failed to meet expectations due to challenges in integrating with legacy technologies, myriad laws and complex procedures

- A way out may be to acquire one of these smaller lenders and then work on changing the innards to better serve a customer.

Courtesy: Flickr.com

I may not be a mortgage expert – but I beg to differ. I have seen such arguments in other vertical sectors as well – and one by one, the onslaught of new technologies have brought about significant change – and even Wall Street is beginning to notice.

- Sectors which are prone (and perhaps should be disrupted) are those with

- High margins

- Antiquated technologies

- Poor customer service

- Opaque processes

- One could easily argue from reading his post that many of these points do apply. The top 200 officers may outclass any robo-originator in service, but when you realize that the median income is only $40,000 – I would daresay that the overall customer satisfaction is low (one reason I love looking at numbers – depending upon what and how you look at it, the picture could be gloomy or rosy) .

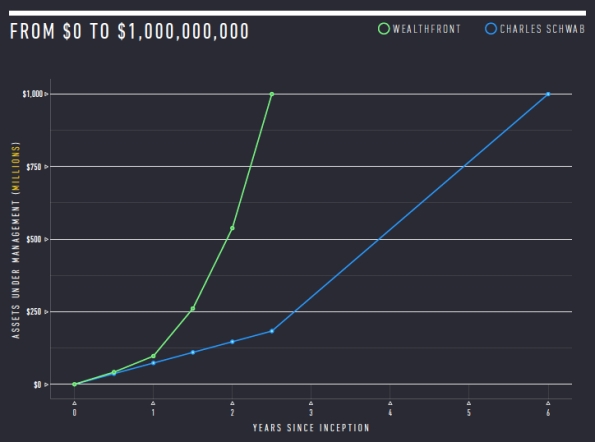

- While Aaron does rightly point out that the revenues are low, what is also clear is that these services have experienced a strong growth trajectory. In part this is also driven by its customer base – potentially a younger, savvy audience who are more attuned to a “digital approach”. While this is small, it is growing – and will be the norm in the future. As a case in point I would refer to both Wealthfront and Betterment; in both these cases their portfolios are dwarfed by giants such as Vanguard – but their astonishing growth points to what is coming. No wonder, incumbents such as Vanguard themselves have established similar Robo-advisors.

Courtesy: Wealthfront

- Another point made is to acquire a lender and then begin to innovate. I am not sure that is a wise decision, unless it comes with a ready stream of customers. An example of this would be Worldpay versus Adyen or Stripe. They all are in the payments business but the latter two have built a efficient business from the ground up – using the latest of what technology has to offer, while Worldpay – although innovative has to balance both new and legacy needs. This is hard to do so – no wonder larger players find it so difficult to compete. The new players have none of this baggage to deal with and hence are far more flexible to respond to changing business needs.

We don’t need another technology patchwork to mend what is a stodgy business. We do need a fresh look and a willingness to invest and challenge the status-quo. When hurdles present themselves – firms will find a way, if there is a clear and present need. SoFi recently launched hedge fund points to this.

We need more disruption, not less. The mortgage industry as a whole could well deserve it!