Archive

The Un-network Uncarrier

Note: The article is the first of a 3-part series which talks Facebook’s Telecom Infrastructure Partnership (TIP) initiative and the underlying motivation behind the same. The next two parts are focused on the options and approaches that Operators and vendors respectively should adopt in order not to suffer the same outcome as what happened in OCP.

When T-Mobile USA announced its latest results on July 19, 2017, CEO John Legere remarked with delight – “we have spent the past 4.5 years breaking industry rules and dashing the hopes and dreams of our competitors…”. The statement rung out true – in 2013 the stock hovered at a paltry USD 17.5 and now was close to USD 70 – with 17 straight quarters of acquiring more than a 1m customers per quarter. If anything – the “Un-carrier” has yet proven unstoppable. While this track record is remarkable, my hypothesis is that in the long term the “uncarrier” impact may seem puny compared to “un-network” impact which could potentially upend the entire Telecom industry – operators and vendors alike. If you are still wondering what I am referring to – then it is TIP, the open Telecom Infrastructure Initiative started by Facebook in 2016 which now counts more than 300 members.

The motivation for TIP came on the heels of the wildly successful Open Compute Project (OCP). OCP, whose members include Apple, Google and Microsoft heralded a new way to “white-box” a data center based upon freely available specifications and a set of contract vendors ready to implement based upon preset needs. It also heralded a new paradigm (now also seen in other industries) – you didn’t need to build and own it… to disrupt it (think Uber and Airbnb). And while many may falsely be led to believe the notion that this is primarily for developing countries in the light of the Facebook goal to connect the “un-connected”, I believe the impact will be for both – operators in developed and developing countries alike. There are a few underlying reasons here.

- A key ingredient in building a world class product is to have a razor sharp focus towards understanding (and potentially forecasting) your customer/ user needs. While operators do some bit of that, Facebook’s approach raises the bar to an altogether different level. And in this analysis – one thing is obvious (something which operators also are painfully aware of); people have a nearly insatiable quest for data. A majority of this data is in the form of video; unsurprisingly video has become a major focus across all Facebook products – be it Facebook Live, Messenger Video calling or Instagram. The major difference between the developing and developed world in this respect is the expectations of what data rates to expect, and the willingness (in many cases the ability) to pay for the same.

- In the 1st world nations, 5G is not a pipe-dream anymore and has operators worried about the high costs associated in rolling out and maintaining such a network (not to forget the billions spent in license fees). In order to recoup this, there may be an impulse to increase prices – which could swing many ways; people grudgingly pay; consumers revolt resulting in margin pressure – and lastly – people simply use less data. The last option should worry any player in the video game; what if people elect to skip the video to save costs!

- Among the developing world, 5G may still be someway off, but here in the land of single digit ARPU’s, operators have a limited incentive for heavy investment given a marginal (or potentially negative ROI). On top of that there is a lack of available talent and heavy dependence on vendors – those whose primary revenue source comes from selling even more equipment and services; all increasing the end price to the consumer.

Facebook has it’s fingers in both these (advanced and developing market) pies and while its customers may be advertisers, its strength comes from the network effect created by its billion strong user base and it is essential to provide these with the best experience possible.

These users want great experiences, higher engagement and better interaction. Facebook also knows another relevant data point – that building, owning and operating a network is hard work, asset heavy and not as profitable. It has to look no further than Mountain View where Google has been scaling down its Fiber business. Truck rolls are frankly – not sexy.

It is not that operators were not aware of this issue, but traditionally lacked the knowhow needed to tackle this challenge which required deep hardware expertise. This changed with the arrival of “softwarization” of hardware in the form of network function virtualization. Operators were not software guru’s ….. but Facebook was. It recognized that by using this paradigm shift and leveraging its core software competencies it could potentially transform and potentially disrupt this market.

Operators could leverage the benefit of open source design to vastly drive down the costs of implementing their networks; vendors would no longer have the upper hand and disrupt the current paradigm of bundling software, hardware and services. Implementations could potentially result in a better user experience – with Facebook as one of the biggest beneficiaries. Rather than spend billions in connecting the world, it would support others to do so. In doing so, it would have access to infrastructure that it helped architect without owning any infrastructure. In short – it would be – the “un-network – uncarrier”.

Home Mortgage – ripe for disruption

Aaron LaRue penned an article “Why Startup’s can’t disrupt the mortgage industry” on Techcrunch yesterday where he elaborated on several factors which pointed to the fact that

- The top 200 loan officers in the country made, well way more than revenues of all the startup’s in this space

- Current attempts to disrupt this have failed to meet expectations due to challenges in integrating with legacy technologies, myriad laws and complex procedures

- A way out may be to acquire one of these smaller lenders and then work on changing the innards to better serve a customer.

Courtesy: Flickr.com

I may not be a mortgage expert – but I beg to differ. I have seen such arguments in other vertical sectors as well – and one by one, the onslaught of new technologies have brought about significant change – and even Wall Street is beginning to notice.

- Sectors which are prone (and perhaps should be disrupted) are those with

- High margins

- Antiquated technologies

- Poor customer service

- Opaque processes

- One could easily argue from reading his post that many of these points do apply. The top 200 officers may outclass any robo-originator in service, but when you realize that the median income is only $40,000 – I would daresay that the overall customer satisfaction is low (one reason I love looking at numbers – depending upon what and how you look at it, the picture could be gloomy or rosy) .

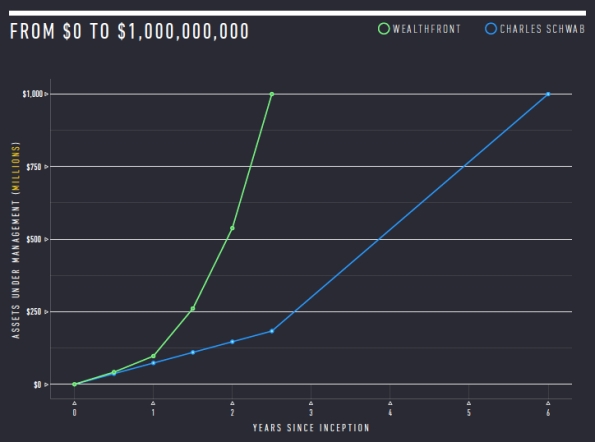

- While Aaron does rightly point out that the revenues are low, what is also clear is that these services have experienced a strong growth trajectory. In part this is also driven by its customer base – potentially a younger, savvy audience who are more attuned to a “digital approach”. While this is small, it is growing – and will be the norm in the future. As a case in point I would refer to both Wealthfront and Betterment; in both these cases their portfolios are dwarfed by giants such as Vanguard – but their astonishing growth points to what is coming. No wonder, incumbents such as Vanguard themselves have established similar Robo-advisors.

Courtesy: Wealthfront

- Another point made is to acquire a lender and then begin to innovate. I am not sure that is a wise decision, unless it comes with a ready stream of customers. An example of this would be Worldpay versus Adyen or Stripe. They all are in the payments business but the latter two have built a efficient business from the ground up – using the latest of what technology has to offer, while Worldpay – although innovative has to balance both new and legacy needs. This is hard to do so – no wonder larger players find it so difficult to compete. The new players have none of this baggage to deal with and hence are far more flexible to respond to changing business needs.

We don’t need another technology patchwork to mend what is a stodgy business. We do need a fresh look and a willingness to invest and challenge the status-quo. When hurdles present themselves – firms will find a way, if there is a clear and present need. SoFi recently launched hedge fund points to this.

We need more disruption, not less. The mortgage industry as a whole could well deserve it!

AI – rescuing the spectrum crunch (part 3)

Part 1 of this post was all about the reasons why DARPA was right when it assigned a Grand Challenge to try and tackle the looming spectrum crises. Part 2 talked about the operating scenarios – on how this could probably pan out in practice. In this concluding chapter I will attempt to determine the impact for both traditional and new players.

_________________________________________________________________

For the regulator, it brings the “uberization” concept right to his doorstep – promoting economic virtues of the efficient utilization of spectrum. Since spectrum could be acquired “on the fly”, the upfront payments made by operators would be replaced by transaction based income with dynamic pricing based upon supply and demand. It would dissuade spectrum hoarding and introduce a heightened level of competition – one which could benefit the end consumer.

For the operator, it would significantly level the playing field since all operators would have access to the same spectrum – one they previously acquired for exclusive use. Those operators which would successfully woo the customer would win; premium operators would be able to engage high value customers by securing access to additional spectrum and hence additional capacity. It would open up a market for newer players not willing to play that game – instead targeting lower tier customers (those who potentially do not need high speed data). The lack of upfront investment in spectrum would allow operators to efficiently allocate capital to better serve customer needs. They could also sell this capability as a service to other service providers (a.k.a. Netflix) who may need a particular QoS and throughput – and are willing to pay for it.

But the biggest impact I suspect will be for the newer entrants. All these players seek to provide a great user experience to the customer irrespective of his operator. If we take a potential case such as 4K streaming where only one provider has a majority of the spectrum – then trying to stream with another operator would result in a poorer user experience (this of course leads to a lock in scenario) . With dynamic allocation – you could simply define different tiers (and quality levels) for your users and partner with all infrastructure players (e.g. operators) to ensure that spectrum can be made available on demand for your service; thus ensuring a high quality experience (for the money you have paid).

Does it drive the operator down the bit pipe…. perhaps yes and no. While the operator would not be the face to the end customer, it would by its very nature foster a closer collaboration between the operator and the end service provider. The customer could very well be the ultimate winner – with companies pandering to best serve their needs.

With potential global ramifications – I see some very clever ideas coming out of the wood-work, and folks such as Chamath investing in this “world changing” technologies to make a difference. I just hope that the big Telcos and/ or the FCC and other regulators don’t view this as a threat to the status quo – rather an opportunity to derive additional value from an already scarce resource!

AI – rescuing the spectrum crunch (Part 1)

Chamath Palihapitiya, the straight talking boss of Social Capital recently sat down with Vanity Fair for an interview where he illustrated what his firm looked for when investing. “We try to find businesses that are technologically ambitious, that are difficult, that will require tremendous intellectual horsepower, but can basically solve these huge human needs in ways that advance humanity forward”.

Around the same time, and totally unrelated to Chamath and Vanity Fair, DARPA, the much vaunted US agency credited among other things for setting up the precursor to the Internet as we know it threw up a gauntlet at the International Wireless Communications Expo in Las Vegas. What was it: it was a grand challenge – ‘The Spectrum Collaboration Challenge‘. As the webpage summarized it – “is a competition to develop radios with advanced machine-learning capabilities that can collectively develop strategies that optimize use of the wireless spectrum in ways not possible with today’s intrinsically inefficient static allocation approaches”.

What would this be ‘Grand’? Simply because DARPA had accurately pointed out one of the greatest challenges facing mobile telephony – the lack of available “good” spectrum. In doing so, it also indirectly recognized the indispensable role that communications plays in today’s society. And the fact that continuing down the same path as before may simply not be tenable 10 – 20, 30 years from now when demands for spectrum and capacity simply outstrip what we have right now.

Such Grand Challenges are not to be treated lightly – they set the course for ambitious endeavors, tackling hard problems with potentially global ramifications. If you wonder how fast autonomous cars have evolved, it is in no small measures to programs such as these which fund and accelerate development in these areas.

Now you may ask why? Why is this relevant to me and why is this such a big deal? The answer emerges from a few basic principles, some of which are governed by the immutable laws of physics.

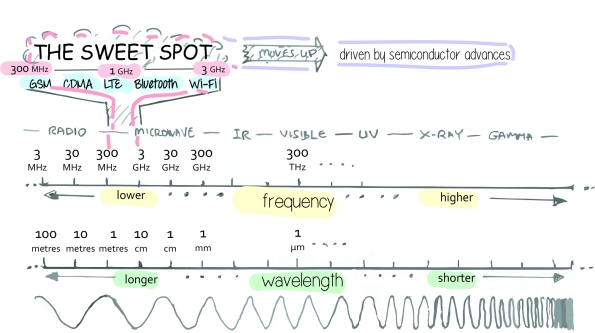

- Limited “good” Spectrum – the basis on which all mobile communications exists is a finite quantity. While the “spectrum” itself is infinite – the “good spectrum” (i.e. between 600 MHz – 3.5 GHz) or that which all mobile telephones use is limited, and well – presently occupied. You can transmit above that (5 GHz and above and yes, folks are considering and doing just that for 5G), but then you need a lot of base stations close to each other (which increases cost and complexity), and if you transmit a lot below that (i.e. 300 MHz and below) – the antenna’s typically are quite big and unwieldy (remember the CB radio antennas?)

Courtesy: wi360.blogspot.com

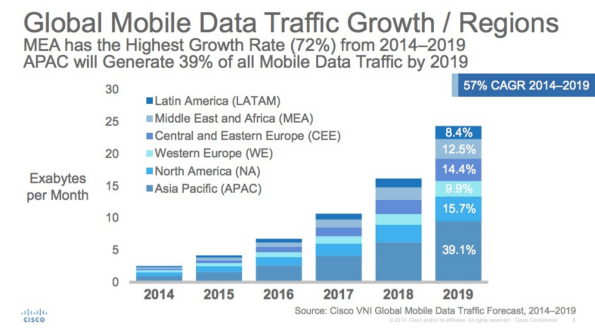

- Increasing demand – if there is one thing all folks whether regulators, operators or internet players agree upon it is this; that we humans seem to have an insatiable demand for data. Give us better and cheaper devices, cool services such as Netflix at a competitive price point and we will swallow it all up! If you think human’s were bad there is also a projected growth of up to 50 Bn connected devices in the next 10 years – all of them communicating with each other, humans and control points. These devices may not require a lot of bandwidth, but they sure can chew up a lot of capacity.

CISCO VNI

- and as a consequence – increasing price to license due to scarcity. While the 700 MHz spectrum auction in 2008 enriched the US Government coffers by USD 19.0 Bn (YES – BILLION), the AWS-3 spectrum (in the less desirable 1.7/2.1 GHz band) auction netted them a mind-boggling USD 45.0 Bn.

One key element which keeps driving up the cost of spectrum is that the business model of all operators is based around a setup which has remained pretty much the same since the dawn of the mobile era. It followed a fairly, well linear approach

- Secure a spectrum license for a particular period of time (sometimes linked to a particular technology) along with a license to provide specific services

- Build a network to work in this spectrum band

- Offer voice, data and other services (either self built) or via 3rd parties to customers

While this system worked in the earlier days of voice telephony it has now started fraying around the edges.

- Regulators are interested that consumers have access to services at a reasonable price and that a competitive market environment ensures the same. However with a looming spectrum scarcity, prices for spectrum are surging – prices which are indirectly or directly passed on to the customer

- If regulators hand spectrum out evenly, while it may level the playing field for the operator it does nothing to address a customer need – that the capacity offered by any one operator may not be sufficient… leaving everyone wanting for more, rather than a few being satisfied

- Finally, the spectrum in many places around the world remains inefficiently used. There are many regions where rich firms hoard spectrum as a defensive strategy to depress competition. In other environments there are cases when an operator who has spectrum has a lot of unused capacity, while another operator operates beyond peak – with poor customer experience. No wonder, previous generations of networks were designed to sustain near peak loads – increasing the CAPEX/ OPEX required to build up and run these networks.

In the next part of this article we will dive deeper into these issues, trying to understand how an AI enabled dynamic spectrum environment may work and in the last note point out what it could mean to the operator community and internet players at large…..

The curse of the gatekeeper – thoughts on Eyeo and Shine

A trip up the Rhine is one of those quintessential romantic getaway’s that should be on everyone’s bucket list should they pass through Cologne, Germany. The calm meandering river, multitude of castles and vineyards that dot the hills are a sight to behold. When taking this trip, at a spot around a bend, one comes across an interesting sight. A mini-fort perched upon a rocky outcrop in the middle of the river. As the story goes, an entrepreneurial nobleman built it to collect levy from the numerous barges that moved up and down. Failure to pay nearly always meant that you were … well easy pickings to the cannons pointed right at you. Some called this simply a “tax collector”, others “a gatekeeper”…. still others an “extortionist” (among the kinder choice to words to be used).

It brings us to the subject of my note today – that of ad-blockers whether browser or network based (with Eyeo and Shine their key proponents). First, some basic context to this discussion is necessary. A majority of us are blissful consumers of the “internet” and in many countries it has become an essential and indispensable feature of our existence, along with water, food, electricity and telecommunications. Could you imagine life without it? One the the key reasons behind this dependency (and for many – an addiction) is the simple fact that most of it is free. You heard that right – FREE. When you pay your monthly Internet bill, you are not paying for the content, but to use the infrastructure that the cable and telecom providers have put in to access the internet. On the actual web itself you have two broad classes of content; transaction, such as web-shops where people hope you will buy something, and ad supported. While there are indeed a several instances of malicious advertising and malware etc., for many portal advertising is a necessary evil. The money earned simply pays the bills to create and host this content. Leading respected publications such as ARS Technica have come out in the public, pleading with their readers to allow ads, without which they would have to either turn to a pay per use (paywall) approach or simply turn off the lights. While the former approach does work in select cases (e.g. the Wall Street Journal) for a majority of long tail content, ads are the only source of revenue. Even sites such as Wikipedia raise money every year in order to keep their site ad free. That’s about it – either the consumer pays, or the advertiser pays, there is nothing like a free lunch.

This is where folks such as Eyeo with its Adblock Plus and Shine with its network based technologies enter the game. While free to download in the case of Adblock, it effectively blocks publishers from displaying advertisement unless they agree to pay Eyeo to be white-listed and adopt their standard. While they do have guidelines of what kind of ads are allowed, Eyeo still retains the ultimate authority on which ads are permitted and which not. The claim is the the user will have a “better customer experience”. Better than what? would it be better that the websites that users use went to a paywall model so that customers had to pay each time they accessed a website without advertisements, or that they no longer had access to the website because the firm went bust over a loss of revenue. In the case of Shine, advertisements are blocked at the network level; while some operators such as Three have signed up, others such as O2 have hesitated. Not suprising, while you may want to strong arm Google a bit, an operator still depends upon Google for its Android OS – and need to satisfy their customers. At the same time, advertising is also driving new revenue streams, so better to work towards more engagement rather than destroy this all together. Taking this in mind We must ask ourselves a few questions

1. Just as we may distrust Facebook or Google, can we trust a for-profit firm to have our best interests as a consumer? and in many cases – if it was a governmental entity – would you trust a government?

2. If we do not want to end up paying to access content or loosing access altogether, are we willing and able to tolerate advertisements as a necessary evil

3. Does better customer experience imply no advertisements at all – or perhaps, more relevant advertisements tailored to my interests?

If for any reason the first two answers are no, and we still do not want advertisements, then one option would be to charge a “tax” similar to the UK BBC tax or the TV tax in Germany. Although this may sound simple – it is a lot harder than you may think. Questions would arise such as “is this tax to be uniform – or dependent upon how much you consume; or how do you distribute the monies to all the content producing firms – especially if they may not even be registered in your country?” In this digital day and age – this is easier said than done. My hunch is that the solution lies in the third answer – to offer a better customer experience (to those who desire it) by more relevant advertisements. If you didn’t want to be tracked, you would still get advertisements, perhaps not as relevant – but this is a trade-off that you as a consumer would make.

This may sound as a death knell to the gatekeepers, but well – neither them nor the fortress on the Rhine were universally liked. By adopting a contorted vision of what a customer-centric browsing experience should be (tailored towards profit taking), it simply introduced a cost to a system – a cost which directly or indirectly would be passed on to you and me, the end customers.

Al la carte versus All you can eat – the rise of the virtual cable operator

Recent announcements by the FCC proposing to change the interpretation of the term “Multi-channel Video Programming Distributor (MVPD)” to a technology neutral one has thrown open a lifeline to providers such as Aereo who had been teetering on the brink of bankruptcy. Although it is a wide open debate if this last minute reprieve will serve Aereo in the long run, it serves as a good inflection point to examine the cable business as a whole.

“Cord cutting” seems to be the “in-thing” these days with more people moving away from cable and satellite towards adopting an on-demand approach – whether via Apple TV, Roku or now – via Amazon’s devices. This comes from a growing culture of “NOW“; rather than wait for a episode at a predefined hour, the preference is to watch a favorite series at a time, place – and now device of ones choosing. Figures estimate up to 6.5% of users have gone this route, with a large number of new users not signing up to cable TV in the first place. The only players who seem to have weathered this till date are premium services such as HBO who have ventured into original content creation, and providers offering content such as ESPN – the hallmark of live sports. Those who want to cut the cord have to end up dealing with numerous content providers – each offering their own services, billing solutions etc. To put together all the services that users like, ends up being a tedious and right now – and expensive proposition.

This opens the door for what can only be known as the Virtual Cable Operator – one which would get the blessings of the FCC proposal. Such an aggregator (could be Aereo) could bundle and offer such channels without investment into the underlying network infrastructure – offering a cost advantage as much as 20% as compared to current offerings. This trend is a familiar one in the Telco business – and cable companies better be ready for this. Right now they may be safe as long as ESPN doesn’t move that route – but with HBO, CBS etc all announcing their own services, I believe it is only a matter of time. While the primary impacts to cable has extensively been covered – there are a few other consequences, and opportunities that I would like to address.

The smaller channels (those who charge <30c to the cable operators) will experience a dramatically reduced audience. Currently there was a chance that someone would stop by while channel flipping – with an al la carte service – this pretty much disappears, and along with it advertising revenue. An easy analogy would be that of an app in an app store – app discovery (in this case channel discovery) becomes highly relevant. Another result is that each channel would be jockeying for space on the “screen” – whether a TV, tablet or phone. I can very well imagine a scenario of a clean slate design like Google on a TV, where based upon your personal interest you would be “recommended” programs to watch – question is who would control this experience…

Who could this be – a TV vendor (a.k.a a Samsung – packaging channiels with the TV), an OEM (Rovio, Amazon etc.), a Telco or cable provider (if you can’t beat them – join ’em), or someone like Aereo? The field is wide open and the jury has yet to make a decision. One thing however is clear – the first with a winning proposition – including channels, pricing and excellent UI would be a very interesting company to invest in…..